What shall we expect to our CPF at Age 55?

Reaching 55 is a significant milestone. It means you are one step closer to retirement. Here are some things you should know about your Central Provident Fund (CPF) to help you plan better.

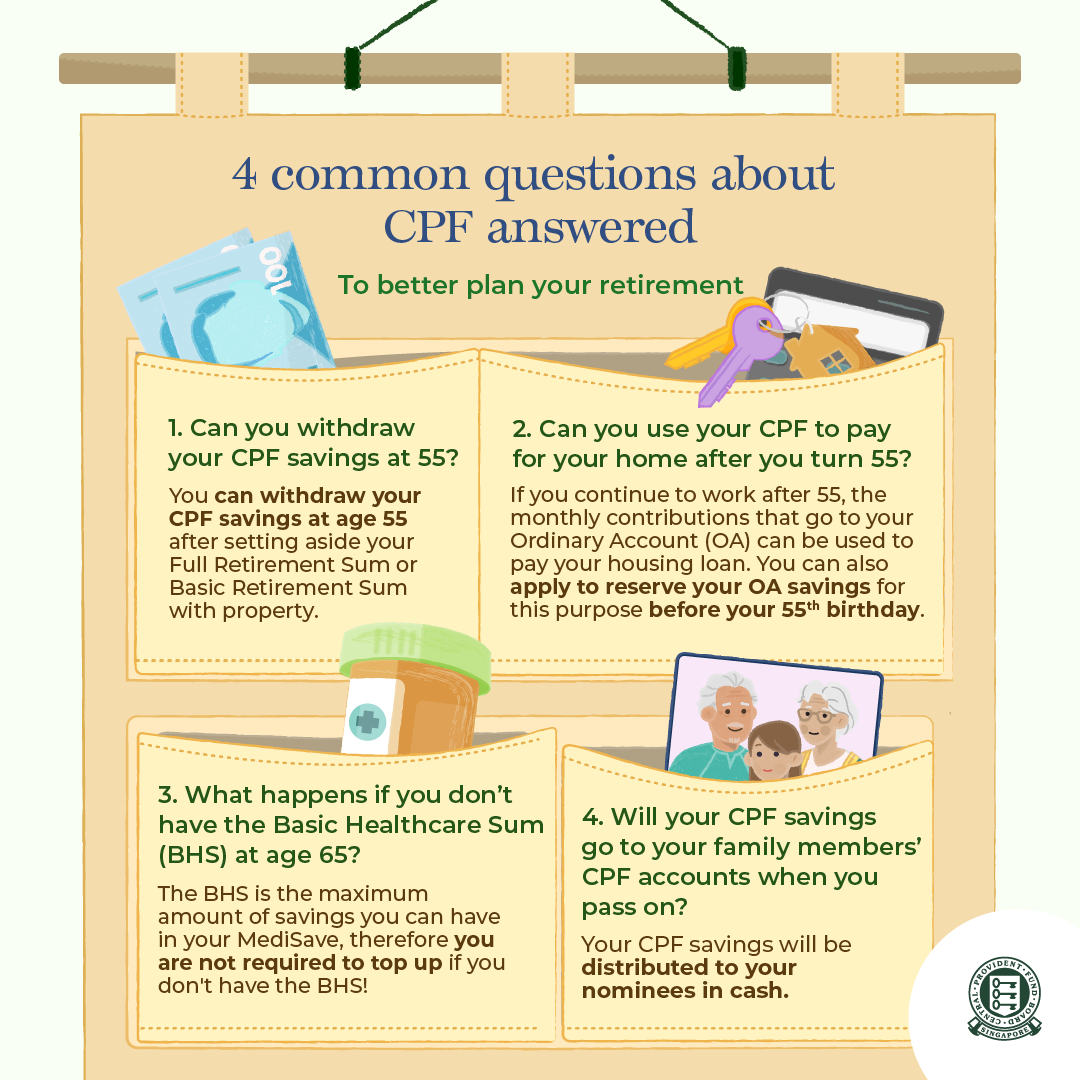

A CPF member will receive a letter from CPF Board six months before their 55th birthday. He or she can apply to withdraw the CPF savings from 55 by submitting an online application. The withdrawal of savings has always been optional and we should understand the pros & cons in doing so.

Retirement Account (RA) Created at Age 55

Your CPF plays a crucial role in your future, through building your retirement savings and taking care of your basic housing and healthcare needs. Your CPF savings has steadily grown since you started working, and once you turn 55, there are a few decisions you’ll have to make.

From age 55:

- Your Retirement Account (RA) will be automatically created for you when you turn 55. Your CPF savings from your Special Account (SA) and Ordinary Account (OA) will be auto transferred to your RA, up to your Full Retirement Sum (FRS). Your Special Account (SA) savings will be transferred first, followed by your Ordinary Account (OA) savings.

- For higher payouts in retirement, you can top up your RA to the Enhanced Retirement Sum (ERS), which is the 2x FRS amount.

If you do not have enough RA savings to make up the FRS and have used your CPF savings for your property, then the amount withdrawn for your property (including accrued interest) will be used to meet FRS. When you sell your property, you will have to restore your RA up to your FRS with your sales proceeds.

It is not mandatory for you to top up your RA if you are unable to set aside your FRS. However, you may wish to top up your RA for higher monthly payouts. You can also enjoy tax relief for cash top-ups up to the FRS.

These funds in RA will be compounded, for the next 10 years, for the purpose of contributing into the CPF LIFE scheme when you turn age 65 (or latest, by age 70). CPF Life, a national annuity scheme that provides you with a monthly payout for as long as you live. The monthly payouts you receive depends on the retirement sum you have set aside in your RA. The more you set aside in your RA, the higher your payouts.

Fulfilling the Retirement Sum

Planning for your retirement is easier with the retirement sums – Basic Retirement Sum (BRS), Full Retirement Sum (FRS), and Enhanced Retirement Sum (ERS). They provide a guide on the CPF savings you need to reach your desired monthly payouts in retirement.

The BRS is meant to provide you with monthly payouts in retirement to cover basic living needs, excluding rental expenses.

The FRS is two times of BRS and can provide you with higher monthly payouts that also cover rental expenses. That is why when you turn 55, your CPF savings up to your FRS is set aside in your Retirement Account (RA) to provide you with monthly payouts in retirement.

If you own a property in Singapore with remaining lease that lasts you until you are 95 or older, you have the flexibility to meet your FRS with a mixture of property (up to half your FRS) and cash, and can apply to withdraw part of your RA savings down to your BRS using your property.

If you wish to receive even higher payouts for your desired retirement lifestyle, you can choose to set aside more by making a top-up, up to the current ERS. The ERS is increased yearly for those who wish to receive higher payouts. The ERS is 3 times the BRS.

Increases in the BRS, FRS and ERS are made by the CPF Board according to their analysis of long-term inflation and rises in the standard of living.

While there is no way to predict the future, looking to the past, the past five years’ Retirement Sums were as follows:

| Year (If you turn 55 in this year…) | Basic Retirement Sum | Full Retirement Sum | Enhanced Retirement Sum |

|---|---|---|---|

| 2017 | $83,000 | $166,000 | $249,000 |

| 2018 | $85,500 | $171,000 | $256,500 |

| 2019 | $88,000 | $176,000 | $264,000 |

| 2020 | $90,500 | $181,000 | $271,500 |

| 2021 | $93,000 | $186,000 | $279,000 |

| 2022 | $96,000 | $192,000 | $288,000 |

| 2023 | $99,400 | $198,800 | $298,200 |

| 2024 | $102,900 | $205,800 | $308,700 |

| 2025 | $106,500 | $213,000 | $319,500 |

| 2026 | $110,200 | $220,400 | $330,600 |

| 2027 | $114,100 | $228,200 | $342,300 |

In the past, there has been an increase of about 3% each year. From 2023 to 2027, the Retirement Sums will increase by 3.5% per year. To estimate the Retirement Sums when you turn 55, you can thus base your calculations on a 3.5% year-on-year increase, bearing in mind that that might change depending on Singapore’s financial future.

What’s Interest I can Earn with CPF?

If you choose to leave your savings in the CPF accounts, there are 3 types of interest rates that you can earn. They are the CPF interest rates, Extra interest rates and Additional extra interest rates.

Interest rates for your respective CPF accounts are:

- OA: 2.5% p.a.

- SA: 4% p.a.

- RA: 4% p.a.

Once your funds are transferred to your Retirement Account, it is set aside for the next 10 years to compound before you can enter the CPF LIFE scheme to start monthly payouts (i.e at the age of 65 to 70 depending on your choices). While your funds are sitting in your Retirement Account, it continues to earn an annual interest return.Your CPF monies in your CPF RA can earn interest rates of up to 6% p.a.

| Retirement Account Balances | Interest Returns (per annum) |

|---|---|

| First $30,000 | 6.0% |

| Next $30,000 | 5.0% |

| Remaining balances | 4.0% |

If you have no pressing need for the money, you can leave it in CPF to continue enjoying a risk-free interest rate of at least 2.5% (OA). Before withdrawing your CPF savings, ensure that proper planning is done to avoid spending your retirement funds unnecessarily.

Can I withdraw? How much and How Frequent?

How much you can withdraw depends on how much money you have in your CPF Ordinary Account (OA), Special Account (SA), and Retirement Account (RA)… and if they hit the current Full Retirement Sum (FRS). In addition, if you own a property with a lease that’s valid until you turn 95 years old (and beyond), the government thinks that you are financially safe for the rest of your life.

Thus, the requirements for your CPF Retirement Account balance will be more relaxed, i.e

If you do not have property and manage to hit the FRS, you will be able to withdraw $5,000 or any sums in excess of the FRS in your account, whichever is higher.

On the other hand, if you are a property owner (can last you to 95) and manage to hit the FRS, you’ll be able to withdraw any sums in excess of the BRS that you have in your Retirement Account. However when you decide to sell your property, you must refund proceeds to your CPF and restore your RA up to the FRS.

Withdraw as often as you like, in full or partial amounts

You may need extra funds from time to time. Ad hoc withdrawals give you extra flexibility to access funds when you need them. You can make as many withdrawals as you like from your withdrawable savings. So there’s no need to take everything in one go. Here is a summary of how much you can withdraw from your CPF Account at age 55:

For property owners, the property must last you until age of 95

| How much money do you have in your CPF OA & SA? | I can withdraw from my CPF… |

| $0 – $5,000 | Everything |

| For Property Owner: $5,000 – BRS For Non Property Owner: $5000 – FRS | $5,000 |

| For Property Owner: Above BRS | Everything in your SA & OA above BRS |

| For Non Property Owner: Above FRS | Everything in your SA & OA above FRS |

How to Withdraw?

In short, go to www.cpf.gov.sg – login with your Singpass – provide your bank account (e.g DBS/ POSB/ OCBC/ UOB). Alternatively, you can choose to receive your CPF withdrawal via PayNow.

To start withdrawing, you will need to complete the application with CPF Board, and follow through the guided steps.

Do I need to pay taxes for the amount I withdraw from my CPF accounts?

No, CPF savings withdrawn are not taxable.

However, please note that if you have any unpaid taxes or MediShield Life premiums, we may recover the unpaid amount from the CPF savings you are withdrawing.

This is done to ensure that everyone fulfils their tax obligations and has sufficient coverage under MediShield Life.

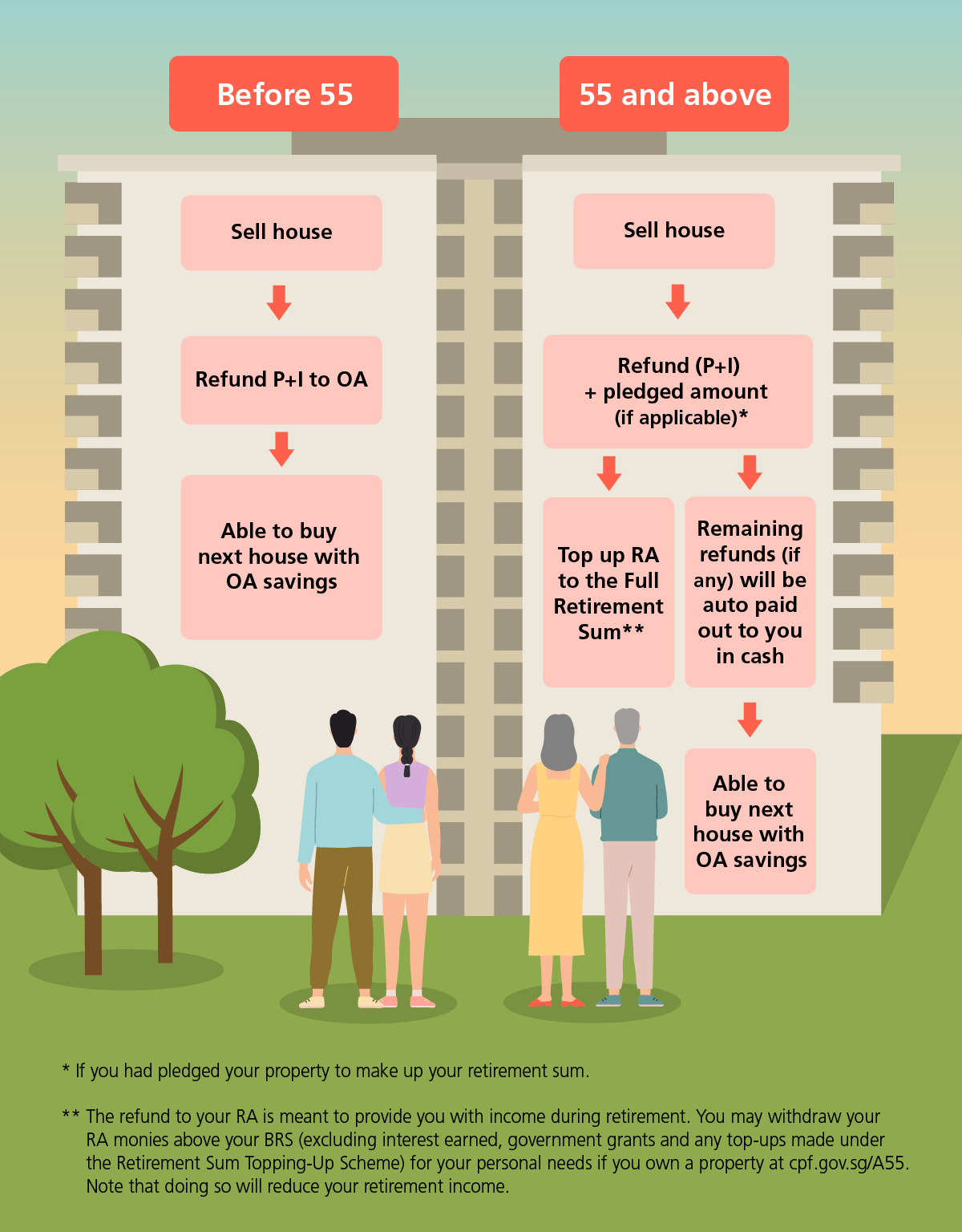

What If I sell the Property, where the money goes to? Can I reuse it to purchase new property?

Upon selling your property, you will need to refund to your CPF savings:

- the principal amount (P) you’ve withdrawn to pay for the property;

- the accrued interest (I); and

- if you had pledged the property to make up your Full Retirement Sum (FRS), this amount will need to be refunded together with the P+I.

CPF savings are primarily meant for your retirement needs and any CPF funds utilised for purchasing a property will reduce the amount available for your retirement. Therefore, all or part of the refunded amount will be used to top up your Retirement Account (RA) to your FRS*. Any balance will be paid to you in cash. You can also inform us if you wish to retain the balance housing refund in your CPF Account(s) instead.

You can then reuse the Ordinary Account savings to purchase your next property, subject to the applicable housing rules and limits.

However, housing limits set by CPF may apply. This is a safeguard against overspending on housing loan repayments at the expense of your retirement savings. Consider keeping some savings to earn attractive CPF interest rates and use them to boost your monthly payouts in retirement.

Can I still use CPF to pay for the monthly mortgage instalment?

When you reach 55, savings from your SA, followed by savings from your OA, will be transferred to create your RA to fill up to the FRS.

Any balance that remains in your OA can be used for your housing loan repayments. If you continue to work after 55, you can use the monthly contributions that go to the OA to service your mortgage, even if you have not met your applicable Retirement Sum.

However, housing limits set by CPF may apply. This is a safeguard against overspending on housing loan repayments at the expense of your retirement savings. Consider keeping some savings to earn attractive CPF interest rates and use them to boost your monthly payouts in retirement.

If you need to continue using your OA for your housing payments after age 55, you may apply to reserve your OA savings for this purpose before they are transferred to your RA. However, do note when you start your monthly payouts (i.e turning 65 to 70), your reserved OA savings will be transferred to your RA if you have not set aside your FRS.