Basic knowledge about Japan Property

Comparing to other places worldwide, properties in Japan are actually very affordable.

During the economic bubble in Japan in the late 1980s, Tokyo’s land prices rose by more than 300%. As the bubble burst, property prices followed the trend and suffered a sharp decrease, dropping down to 50% from their highest point. Years since then, as a result of a long-term economic downturn, property prices had been dropping in a slow rate until 2005. From 2001 to 2006, during the period when Junichiro Koizumi was in office serving as Prime Minister, he promoted the disposal of nonperforming loans and pushed for the urban renewal plan. As a result of the political and economic reforms, the property prices began to rise from 2006. However, when U.S. Subprime Mortgage Crisis hit the world’s economy and along with the aftermath of 2011’s Great East Japan Earthquake, property prices stopped rising and turned back down. Yet, the price drop this time did not return to the low level before Koizumi’s reformation and therefore it was thought that Japanese real estate prices have already reached the lowest of all time between the year 2004 and 2005. By the end of 2012, Shinzo Abe won his second term as prime minister and pushed for quantitative easing, implementing a set of aggressive monetary policies quoted as Abenomics that aims to pull Japan out of its deflationary slump. There was also an impact on the real estate market as property prices again rose since the implementation of Abenomics.

The rental prices of commercial buildings is often seen as one of the indexes to property prices as the commercial real estate is usually moves in tandem with residential properties. Commercial real estate of London and New York has already been recovering to almost 80% from the collapse of Lehman Brothers in 2008; however, Tokyo has only reached 60% in its recovery therefore there is still a very big room for it to rise, in which is seen as a good opportunity for investment. In the same time, the real estate market in many countries like China, Singapore, Canada and Australia seems to be overheated and is heading to a property bubble burst at any time; therefore Japan is attracting much attention from investors all over the world.

It is expected that there will be a stable demand for properties in Japan.

This is mainly due to the reasons listed below. (Research by Pricewaterhouse Coopers and Nomura Research Institute)

Japanese real estate investment market is the second largest in the world, following the United States, which takes up 10% of the world’s market. Japan has a population of 130 million and the GDP is over USD 5.8 trillion, making it the world’s third largest economy. (Hong Kong’s population is 7 million and GDP is USD 260 billion (Sources: Global Finance))

The population of Greater Tokyo is over 34 million and with a GDP of USD 1.5 trillion, it is the world’s biggest metropolitan city. Its population is equal to Canada and Malaysia’s population and its GDP is higher than Australia as a country.

Although there is an overall decreasing trend of population in Japan overall, but the population in Tokyo and other big cities remain to be steadily increasing. It is forecasted that the population will keep on growing overwhelmingly in Tokyo and by 2015 it will be the world’s largest population and GDP.

Tokyo is also a city that hosts 48 of the Fortune Global 500 companies, the highest number of any city (Beijing: 44, Paris: 19, New York: 18).

About 80% of the registered permanent residence in Japan lives in rental properties. This figure increased by approximately 2.6 times since the 1980’s and it is forecasted that the demand for rental properties will keep on increasing.

Politically Stable & Comprehensive Legal System

Real estate is a fixed asset and the investment amount tends to be big in figures, therefore it is a big risk to invest in politically unstable countries or places that do not have a comprehensive legal system. From this perspective, it can be said that the risk of investing in Japan is extremely low.

Japan is a country with a mature legal system, sales and purchases of real estate and related matters are strictly protected by the laws. The restriction of purchasing and owning real estate by foreigners had already been lifted since 1997; thus foreigners can now easily acquire a property in Japan.

Even from a political aspect, Japan is a very stable place as it is generally considered that the likelihood of change of governance due to coup d’etat or party alternation would be tremendously low. Moreover, since its defeat in World War II after 1945, the government of Japan as well as the whole nation has been in a proactive role in being a contributor to peace, pursuing a foreign policy based on peace. Therefore, the risk of outbreak of war and terrorist attack in Japan is the lowest in the world.

With the standard of education growing and the gap between rich and poor shrinking, as well as an effective police force, Japan is often considered to be a very safe place as compared to other countries. There is a saying that Japan is such a safe place that “even if you accidentally dropped your wallet somewhere on the road, no one would steal it and you will definitely find it back.”

Being situated on the Pacific Ring of Fire which means it is prone to earthquakes, it is well-known that Japan is very strict with its building codes and high-rise buildings have to meet a set of strict building regulations.

Building codes are revised and amended every time when a big earthquake occurs in Japan. Earthquake resistant standards for buildings are also stricter over time.

In 1950, the Building Standard Law (commonly known as Kyu-Taishin) was introduced as a response to the earthquakes that took place in 1948. Following the Tokachi-oki Earthquake in 1968, there were amendments made to the Building Standard Law in 1971 upgrading the standards for reinforced concrete columns to be used. The effectiveness of the Building Standard Law was seen during the Hanshin Earthquake that happened in 1995. Almost none of the buildings that were constructed after Kyu-Taishin collapsed.

The damages resulting from the 1978 Miyagi Earthquake led to a new revision of the law again in 1981, bringing the New Earthquake Resistance Building Standard Amendment (commonly known as Shin-Taishin). This new standard not only strengthened the building structure itself, it also added a new concept of adding more flexibility to the structure so that it can allow the building to dissipate the damaging energy from earthquakes through the action of swaying. As a result, almost none of the buildings, as long as they are built to the Shin-Taishin standards, collapsed during the 2011 Great East Japan Earthquake.

Floor Area Calculation

When calculating the floor area, some countries such as Hong Kong, Taiwan etc. will usually display the gross floor area which takes the spaces such as the common hallways and common facilities into account. In Japan, we only use the net floor areawhich excludes the balcony and common hallways

Parking Lot

In Singapore, it is common that the parking lot comes along with the condominium unit. In some other countries, purchasing the parking lot along with the residential unit is common practice.

In Japan, parking lots in residential buildings are usually not open for sale and are only available for renting, therefore the price of the units does not include the price of the parking lot.

Interior Decorations

In Japan, residential units are usually in move-in ready condition when handed over to the buyers. New homeowners only need to get furniture and install air conditioning before moving in.

If it is a property to let, landlords do not need to buy furniture as it is a common practice for tenants to bring in their own furniture (including fridge and washing machine) in Japan, making it much simpler to lease out and manage.

Maintenance Fee

When letting the property, sometimes the maintenance fee is borne by the tenant, but in Japan it is generally borne by the landlord.

Rent

In Japan, rent is usually collected on monthly basis.

Key Money (Reikin)

When letting a property, the landlord will often charge for security deposit (usually equivalent to one or two months of the rent) upon signing the lease contract. In Japan, the landlord can also get key money on top of security deposit. Key money is usually considered as a gift to the landlord (usually equivalent to one or two months of the rent) and it does not need to be returned to the tenant when the lease is up.

*Not all leasing units have key money.

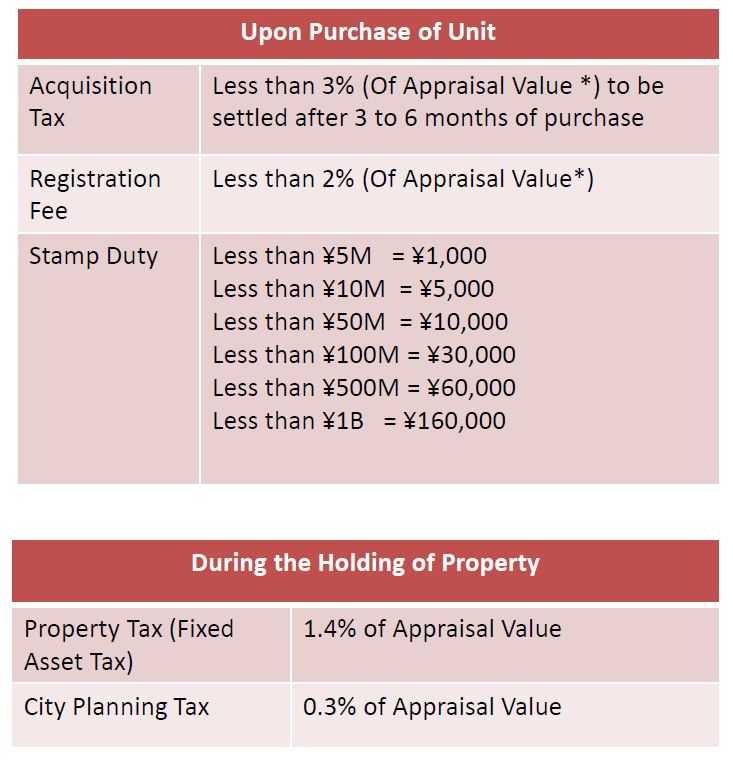

Japanese real estate investment taxes

*Source: Japan National Tax Agency 2012

Acquisition Tax

◆ Registration

◆ Consumption Tax

◆ Stamp Tax

◆ Consumption Tax

Acquisition

Real Estate Acquisition Tax

Real estate acquisition tax is levied on the acquisition of property (except for properties acquired through inheritance)

Amount of Tax = Assessed Value of Property (Tax Base) × Tax Rate(3%)

Non-residential buildings are subject to a 4% tax rate.

Registration License Tax

Various registrations are necessary in order to claim the legal ownership of a property. The registration license tax is calculated as below:

Amount of Tax = Assessed Value of Property (Tax Base) × Tax Rate

The tax rate varies according to the type of registration. For instance, the tax rate for the registration on transfer of ownership ranges from 0.4% to 2.0%, depending on how the transfer occurred.

Consumption Tax

Consumption tax is not levied on the acquisition of lands but only on the acquisition of buildings. The current tax rate is 8%.

Stamp Tax

Stamp tax is levied on contracts involving amounts equal to or over JPY 100,000, with the amount of tax varying according to the contract price. The amount of tax (on a per contract basis) for real estate contracts over JPY 10 million to JPY 5 billion are as follows (the amount in brackets are the reduced rates applicable from 1 April 2014 to 31 March 2018):

| Contract Price (JPY) | Amount of Tax |

| 10 million ~ 50 million | JPY 10,000 |

| 50 million ~ 100 million | JPY 30,000 |

| 100 million ~ 500 million | JPY 60,000 |

| 500 million ~ 1 billion | JPY 160,000 |

| 1 billion ~ 5 billion | JPY 320,000 |

Holding

Fixed Asset Tax (Property Tax)

Fixed asset tax is a municipal tax levied on the registered owner of the property as of January 1st of each year.

Amount of Tax = Assessed Value of Property (Tax Base) × Tax Rate (1.4%)

Reduction of the tax base is available for certain building lots (tax base may be calculated as 1/3 of the value of an acquired residential property). Appropriate application must be made in order to receive benefit of such special rules.

City Planning Tax

City planning tax is a municipal tax levied on the registered owner of the property within a designated planned urbanization area as of January 1st of each year.

Amount of Tax = Assessed Value of Property (Tax Base) × Tax Rate

The tax rate varies according to the area (generally 0.2% to 0.3%; 0.3% in Tokyo 23 Wards). Reduction of tax base is available for certain building lots (tax base may be calculated as 2/3 of the value of an acquired residential property). Appropriate application must be made in order to receive benefit of such special rules.

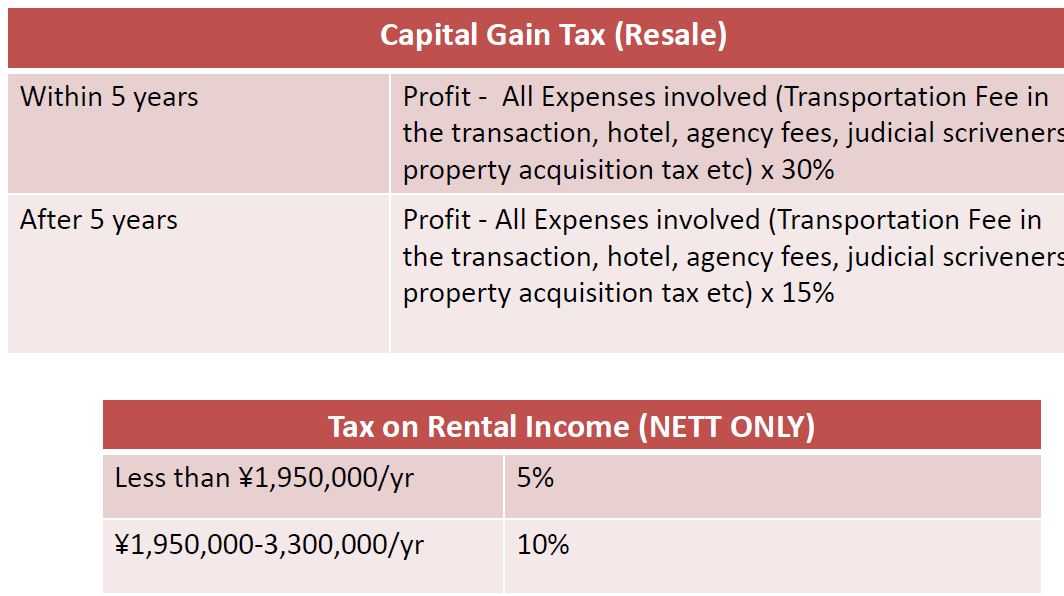

Rental Income

Individual / Corporate Income Tax

Individual / Corporate Income Tax Rental income arising from properties is included in the investor’s gross income and is taxed at a progressive rate.

A 20% withholding tax is deducted from the rent payments to non-resident individuals and foreign corporate investors.

In addition to the national income tax above, resident individual investors and domestic corporate investors are subject to local tax. In the case a foreign corporation is conducting real estate leasing business through a permanent establishment in Japan, it will also be subject to local tax. Individuals may also become subject to business tax if the leasing activities exceeds a certain size.

Depreciation and Other Deductions

Depending on the type of structure and age of the building at acquisition, expenditures can be depreciated over useful life of the asset for individuals and corporate investors under relevant tax rules (e.g. 47 years for brand new residential buildings made of steel reinforced concrete). Investors may deduct expenses (e.g. administrative expense and fixed asset tax) related to income-generating properties from their taxable income.

Interest

As a general rule, individuals may fully deduct the interest payments on loans that are used to acquire rental properties. However, in cases where the real estate investment results in a net loss, there may be a limitation on the amount of deductible interest. Corporations may deduct the entire amount of interest payments.

Consumption Tax

Rent payments for buildings are generally subject to consumption tax. However, consumption tax is not imposed on the rent payments for residential buildings.

Reselling

Capital Gains on the Sale of Real Property

Capital gains on the sale of properties are calculated as follows :

Capital Gains Income = Selling Price – (Acquisition + Sale Related Expenses)

*Individuals may receive the benefit of a special deduction on the capital gains tax from certain types of property (e.g. a property to be used as the main place of residence).

Tax levied on the capital gains from the sale of property will vary depending on whether the investors is an individual or a company, the length of time the property has been held, and whether the owner is a resident or non-resident of Japan.

Capital Gains on the Sale of Shares of a Holding Company

Non-resident individual shareholders who sell their interest of a company that is holding a substantial value of properties in Japan will be taxed at 15% on any associated gain they make on the value of their shares. Any capital gain made by a foreign corporate shareholder on the sale of their shares in such company will be taxed between 22% (18%) to 30%.

Withholding Tax

Non-resident individual and foreign corporate investors are subject to a 10% withholding tax on their Japan sourced income from the sale of buildings and lands.

Consumption Tax

Consumption tax is applied to the transfer of the ownership of a building; the tax rate is 8%. The taxpayer shall be the transferor of the assets (i.e. the seller); however, the tax amount is normally added to the price of the assets and is ultimately borne by the consumers (i.e. the buyer). The transfer of land ownership is not subject to consumption tax.