Navigation Guide

Are you looking for a way to invest and diversify your portfolio without the costly burden of the Additional Buyer’s Stamp Duty (ABSD)? By investing in assets beyond Singapore, you can gain exposure to global equities while avoiding the exorbitant ABSD fee. In this article, we’ll explore how a fraction of the cost can get you access to some of the greatest capital markets around the globe, and provide useful tips on how to stay focused on your investment goals. Read on to learn more about how you can increase your returns by investing beyond Singapore!

Introduction

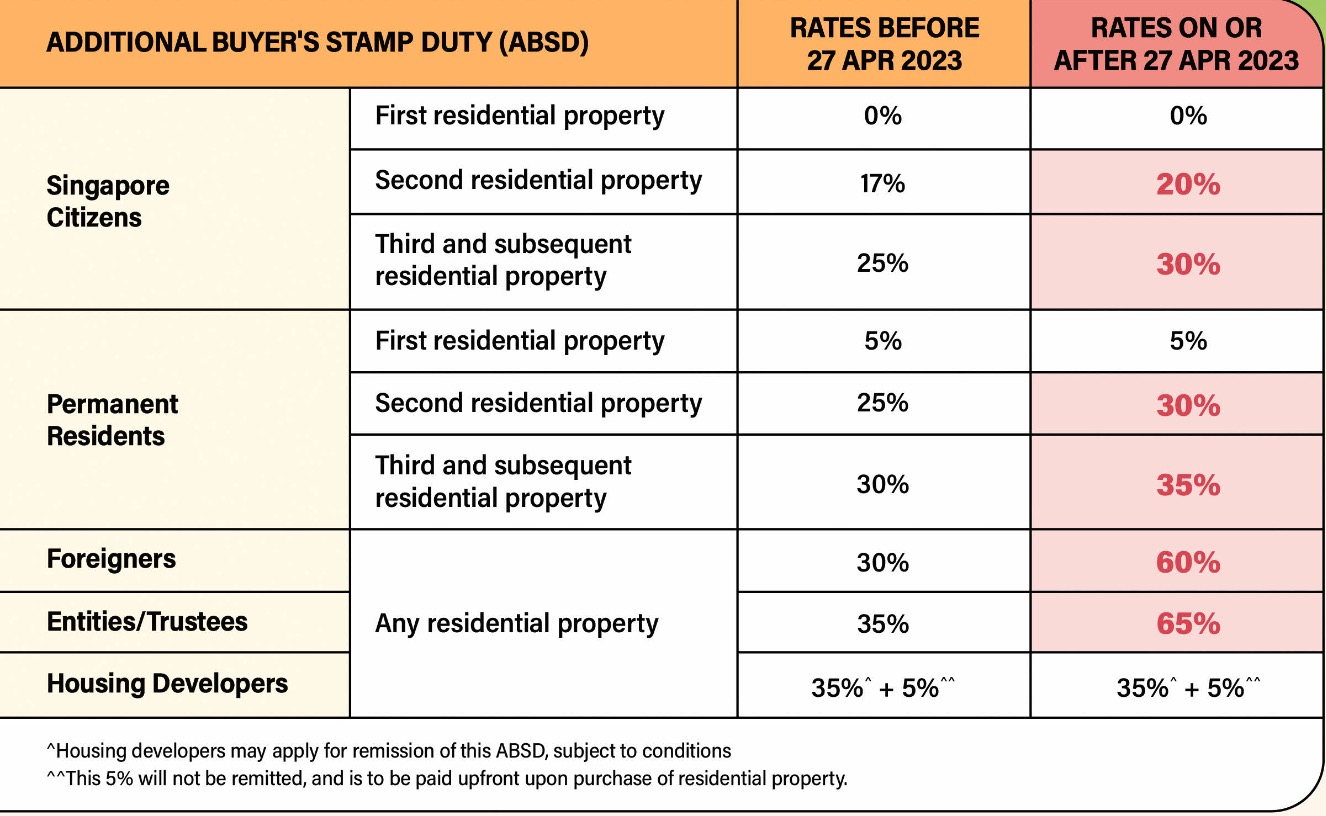

The Singapore government recently announced an increase in the Additional Buyer’s Stamp Duty (ABSD) across the board, which could potentially have a significant impact on real estate investments within the country. To counterbalance this, investors may want to explore alternatives that would allow them to diversify their portfolio beyond Singapore with a fraction of the cost. Investing overseas offers potential opportunities to increase returns and gain exposure to global equities, which may be outside the scope of domestic investments. This article will discuss some asset classes to consider when looking overseas, provide various tips on staying focused on investment goals, and outline the potential benefits of exploring property opportunities beyond Singapore’s borders.

Investors who are looking for ways to diversify their portfolios must first decide what types of assets are best suited for them. Generally speaking, investments can be divided into two main categories: cash-based assets such as stocks, bonds and mutual funds; and non-cash-based assets such as physical commodities or real estate. Cash-based investments provide investors with a liquid form of wealth that can be quickly converted into cash in case of emergencies or opportunities. On the other hand, non-cash-based investments offer the potential for capital appreciation and long-term returns through ownership of property or tangible goods.

For those looking at diversifying their real estate portfolios beyond Singapore and looking for overseas property investment opportunities, there are options like Opus Bay in Batam, Quayside at JBCC, Citadines at Bali, Skypark Celest in Phuket Thailand…etc, just to name a few. Many of these properties are developed by Singapore developers and managed by renowned brands like The Ascott, Marriot, and Banyan Tree Group, providing reliable quality assurance. Furthermore, a fraction of the ABSD amount can often be used to fully pay off many overseas properties.

When investing beyond Singapore’s shores, investors should also keep in mind certain tips for staying focused on their investment goals. It is important to do research into international markets prior to investing—not just focusing on price trends but also on various cultural and political points that might affect one’s investment decisions. It is also recommended to establish realistic expectations about risks involved when investing overseas as well as possible scenarios for when things go wrong—and how they will be addressed. Lastly, it is important to seek the advice of experienced professionals such as the realtor, lawyers or accountants who can help guide investors in making sound decisions with regards to investing abroad.

In Huttons, we had been marketing overseas properties for more than 15years. Our team have versed knowledge about each of the overseas countries we’re marketing for. CS Tee 84188689 had been consistently assist many clients to purchase their investment property in overseas, he is successfully to clinch to the top sales for overseas properties category.

Exploring the Alternatives to Increased ABSD

In light of Singapore’s recent announcement of increased ABSD, investors should consider diversifying their portfolio by exploring opportunities beyond Singapore. Fortunately, there are numerous alternative overseas markets which offer attractive yields with only a fraction of the ABSD cost. The amount of ABSD required is often so small that it can easily be covered with just a fraction of the investor’s total portfolio—allowing them to make an attractive return while still protecting their initial investment.

Investors seeking alternatives should first research these properties to ensure they fit their investment goals. Depending on the property, returns may come in the form of capital appreciation, rental income or a combination of both. Furthermore, investors should research the geographical location and market potential of each property before making any decisions. By taking the time to evaluate each opportunity carefully, investors can maximize their returns and minimize risk.

Another factor for investors to consider is how much each property will cost over its lifetime. This includes not only purchasing costs but also renovation costs and maintenance fees associated with maintaining the property over time. By understanding the long-term costs associated with each property, investors can make informed decisions that achieve optimal returns.

It is important for investors to get familiar with local regulations in each target country prior to investing. In some cases, taxes and other fees must be paid in order for the investor to gain ownership of the property. Furthermore, different countries have different restrictions on foreign ownership and residency requirements; understanding these rules can help investors make sure that their investments remain compliant and profitable over time.

Ultimately, investing beyond Singapore has many benefits despite the increased ABSD rates. With attractive yields and low upfront cost requirements, investors have more options than ever when considering where to invest their money. By taking the time to research properties beyond Singapore’s borders and remaining focused on their investment goals, investors can potentially enjoy higher returns with much cheaper cost than would otherwise be required by ABSD increases within Singapore.

Asset Classes to Consider

Investing beyond Singapore allows investors to diversify their portfolio and gain exposure to global equities. When investing overseas, there are multiple asset classes to consider that have different risks and rewards associated with them.

Real estate investments outside Singapore is an attractive option for investors due to its reliable return on investment and potential for capital appreciation. Many properties overseas developed by Singapore developers come with fully furnished apartments managed by professional teams of management ensuring both quality assurance and maintenance of the property and providing ongoing rental potential from foreign tenants who prefer renting from established and well-managed brands. Additionally, depending on the region where you choose to invest, these properties can also be eligible for various tax benefits or even citizenship programmes that could contribute further to your overall return on investment.

Investing in stocks and bonds can offer investors the opportunity to benefit from international markets with higher yields than those available domestically. While this type of investment may involve more risk than investing in real estate, it could potentially yield higher returns over time since stock prices in international markets are generally less correlated with those in Singapore. Other factors that investors should consider when investing in stocks and bonds include political stability, capital control, currency exchange rates, taxation laws, financial regulations, and macroeconomic performance of the relevant country or region.

Fund investments overseas can also provide investors access to a wide range of assets which can be expected to perform better than domestic funds. Investors should research extensively before choosing a fund investment as there are different types of funds such as mutual funds, index funds, exchange traded funds (ETFs), hedge funds, etc., each with its own set of guidelines, restrictions and associated fees. Moreover, investors should also consider the fund manager’s track record before making a decision.

Lastly, private investments such as venture capital and private equity can provide investors with access to high-growth companies which may not yet be publicly listed. Private investments typically involve higher risk than traditional forms of investment due to their illiquid nature; however, they can also offer greater returns due to their higher risk profile. It is important for investors to do their research thoroughly before committing any money into private investments as there is no guarantee of success or returns in the long run.

In conclusion, exploring investment opportunities beyond Singapore can help investors reap higher returns on their investments while avoiding the higher cost associated with ABSD increases. There are numerous asset classes available when investing overseas such as real estate, stocks and bonds, fund investments, and etc.

Tips on Staying Focused on Investment Goals

When considering investing overseas, it is essential for investors to remain focused on their investment goals. Before making any decisions, investors should determine their risk tolerance and desired return on investment. This includes asking questions such as what types of assets they want to invest in, what sort of returns they are expecting and how long they plan to hold onto the property. Once these criteria have been established, investors should then look for opportunities that are backed by quality developers and reputable management that will help ensure potential returns.

In addition, investors should also be mindful of currency volatility when investing beyond Singapore. Different currencies offer different levels of risk and reward, which can significantly impact potential returns if not managed wisely. Therefore, it is important for investors to familiarize themselves with the associated risks and rewards before deciding on a particular currency for their investments. Furthermore, investors may want to consider building a diversified portfolio of asset classes beyond Singapore such as real estate, stocks, bonds and mutual funds to spread out their risk and increase the potential return from their investments. A mix of global equities may also be an option that will provide exposure to exciting new markets while avoiding the high cost of ABSD.

Finally, by keeping an eye on their investment goals throughout the process, investors will be able to navigate the complex foreign investment landscape with more confidence and make more informed decisions about their investments. Ultimately, this could potentially be a more attractive option than solely relying on the local market with increased ABSD rates.

Benefits of Investing Beyond Singapore

Investing overseas offers several potential benefits to investors. The most obvious benefit is the ability to capitalize on global market opportunities. With just a fraction of the ABSD amount, investors can take advantage of investments in countries like Batam, JBCC, Bangkok and Phuket. Additionally, they can gain access to experienced developers and well-known brands like The Ascott, Marriot, and Banyan Tree Group. These investments come with high quality amenities and services that may not be available in Singapore’s property market.

Moreover, investors may be able to enjoy much higher returns with a much lower cost by taking advantage of these investments. Not only could their money grow more quickly due to potential capital gains but also because of the potential tax benefits in other jurisdictions. Furthermore, investing beyond Singapore’s property market allows investors to diversify their portfolios and reduce risk. This means that investors can spread out their investments across different asset classes, including stocks, bonds, mutual funds, ETFs, commodities and more.

In order to take advantage of these benefits, investors should focus on their investment goals and do their research on any potential investment. It is important to keep track of the markets and trends within each asset class so that they can make informed decisions. Additionally, they should consider the risks associated with each type of investment as well as their own risk tolerance before making any decision. By doing this and staying focused on their goals, investors can ensure that they get the most out of their investments beyond Singapore’s property market.

In Huttons International, on top of local Singapore properties, our research team had brought in a wide selection of property assets from emerging countries like Malaysia, Indonesia, Thailand, Cambodia, and Vietnam, to 1st-tier countries like Australia and United Kingdom. Depending on the individuals investments budgets, and risk levels, we can tailored down to what suit you the best and ensure a peace of mind investment journey with us.

The starting price of investing overseas with Singapore developer in a 5 stars waterfront township is only fr S$85K, which is cheaper than a 10-years COE now! The following are just a portion of the overseas properties which we had carefully selected and bring in to Singapore for marketing.

Conclusion

In conclusion, investing beyond Singapore can be a great way to gain exposure to global equities and mitigate some of the economic uncertainty in Singapore while avoiding the high cost of ABSD. With various options such as Opus Bay in Batam, Quayside at JBCC, Bangkok Property and Phuket Property available, investors seeking to explore beyond Singapore have plenty of opportunities to diversify their portfolios. A trusted developer from Singapore or world-renowned brands such as The Ascott, Marriot, and Banyan Tree Group can provide investors with the assurance they need to invest confidently beyond our shores. What’s more, with just a fraction of the cost of ABSD being able to fully pay off the overseas property investment, it makes sense for investors to consider this alternative option when attempting to stay ahead of market movements while protecting their wealth. In sum, investing beyond Singapore gives investors access to global markets, allows them to diversify their portfolios, and provides a cheaper option for buying property than what local buyers are faced with due to the increased ABSD.

In conclusion, investing beyond Singapore can be a great way to diversify and gain exposure to global equities without the extra cost of the Increased ABSD. From asset classes to consider to focusing on investment goals, this article has outlined guidance to help investors create a successful portfolio. Ultimately, if investors are looking for a cost-effective and potentially lucrative option, then investing outside of Singapore is worth considering.