Navigation Guide

An Executive Condominium (EC) is a type of housing in Singapore that combines elements of public and private housing. ECs are developed and sold by private developers but are subsidized by the government, making them more affordable than private condominiums. Here’s an overview of EC eligibility, key features and FAQs:

If you only got a minute, without further ado or reading the long comprehensive article, let’s go through a few simple questions to get a EC Eligibility pre-assessment for you & family:

Quick Check EC Eligibility

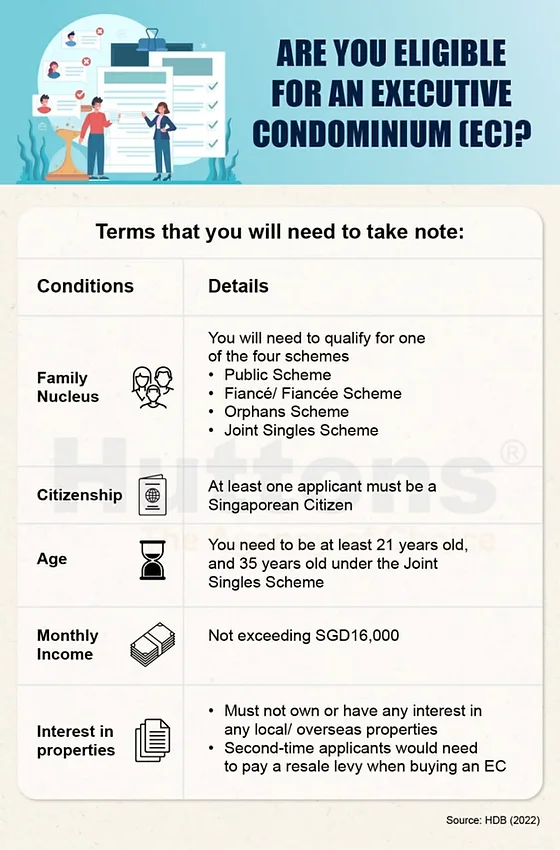

You must meet the eligibility conditions to buy an Executive Condominium (EC) unit from a property developer. Find out if you must pay a resale levy and the conditions that will apply after you buy an EC unit, before you apply for an EC unit.

Citizenship, Schemes, and Age Requirements

Public Scheme

- You and your spouse, and children (if any). An occupier who is married must also include his or her spouse

- You (single) and both your parents, and siblings (if any)

- You (widowed or divorced) and children under your legal custody, care and control

Fiancé/Fiancée Scheme

- You form a family nucleus with your spouse-to-be

- You and your fiancé or fiancée must be unmarried, widowed or divorced (with Certificate of Making Interim Judgement Final having been granted) at the time of the application.

- If you’re NOT taking CPF Housing Grant, you need to produce your marriage certificate for inspection by the Developer, within 3 months after taking possession of the EC unit.

- If you took a CPF Housing Grant, you need produce your marriage certificate for inspection by the Developer before you can take possession of the EC unit.

- If you and your fiancé or fiancée have broken off the relationship and will not be able to submit your marriage certificate, or if the marriage is later annulled, you will not be eligible to buy the EC unit.

- Upon termination of the Sale and Purchase Agreement, the Developer will be entitled to impose forfeiture amount equivalent to 5% of the EC unit’s purchase price in accordance with the Sale and Purchase Agreement.

- If you have been given a CPF Housing Grant, You will have to return the CPF Housing Grant together with interest accrued.

Orphans Scheme

- You must be a Singapore Citizen and a single (unmarried, divorced, or widowed), and your single sibling(s) listed as the buyer(s) or proposed occupier(s) must comprise at least one Singapore Citizen or Singapore Permanent Resident.

- You and your co-buyer(s) must be at least 21 years of age at the time of the application.

- All of the siblings that are single must be listed in the same application

- At least one of your late parents must have been a Singapore Citizen or a Singapore Permanent Resident.

- You and an unrelated orphan who are both Singapore Citizens aged at least 21 at the time of the application can also apply jointly to buy an EC unit under the Orphans Scheme.

Joint Singles Scheme

- You and an unrelated person, both must be single (unmarried, divorced, or widowed)

- All singles must be Singapore Citizens if applying under the Joint Singles Scheme

- At least 35 years old at the time of the application

- Both of you are not eligible the Singles Grant to buy an EC unit

^ If you are a single buying with up to 3 other singles, you and/ or your core applicants must be first-timers to be eligible to buy an EC unit from the property developer.

What If I am an Existing HDB Owners?

If you or any persons listed in the application owns or has an interest in any HDB flat, you must dispose of the flat within 6 months of completion of the EC unit purchase.

Meaning that, you can still buy the new EC (if eligible), and continue to stay in your HDB flat until the EC is completed (handover). Then move in and dispose your existing HDB within 6 months. EC is the best stepping stone for every HDB owners who aspire to own a private condo, without needing to sell your current HDB to avoid ABSD.

However take notes that if you’re taking “Bridging Loan“, i.e using your existing HDB as collateral to finance your EC purchase, then you will need to sell off your existing HDB before the EC completion in order to get the keys.

Am I Considered As – 1st Timer & 2nd Timers? Any Different?

If you’re had over own a subsidised housing unit, you’re considered 2nd timers.

If you and/or any core applicants or core occupiers have taken 2 housing subsidies, you are not eligible to apply or be listed as a core occupier in an EC application.

The subsidised housing unit refers to:

- A flat bought from HDB (i.e BTO)

- A resale flat bought on the open market with CPF housing grant (exclude Proximity Housing Grant)

- A Design Build and Sell Scheme (DBSS) flat bought from a property developer

- An EC unit bought from a property developer

- Other forms of housing subsidy (e.g. enjoyed benefits under the Selective En bloc Redevelopment Scheme (SERS), privatisation of HUDC estate, etc)

What’s the Advantage of Being “1st Timer”:

- Higher Chance on Getting the Choices Units During 1st Day Launch

During the launch, the 2nd timers purchase will be capped at 30% quota of total units. Once the quota is hit, the developer will have to stop the sales to 2nd timers, but they can continue to sell to 1st timer purchase. Thus, 1st timer will have higher chance on getting their choices units during the launch/ preview day.

The 2nd timers quota will be released typically after a month after launch, i.e those 2nd timers who did not manage to get and units can come back again to purchase the balance units.

2. No Resale Levy

As this is your 1st timer getting an subsidised HDB/ EC, thus there’s no resale levy to be paid.

As EC is a form of “Heavily Subsidized Condominium“, the 2nd timer who had enjoyed the subsidies (CPF Housing Grant) before, will be subjected to Resale Levy depending on the bedroom types.

The Different of Owners VS Occupiers for HDB & EC?

Let’s take a quick glance of the keys different of the Owners vs Occupieres.

| Descriptions | Owners | C |

|---|---|---|

| Legal Right | Yes | No |

| Usage of Income for Bank Loan & CPF to serve mortgage | Yes | No |

| Subjected to 5 Years MOP (Minimum Occupation Period) | Yes | Yes |

| Subjected to ABSD if buy another house after 5 Years MOP | Yes | No |

An essential occupier refers to a family member who forms a family nucleus with the owner, and qualifies under a HDB scheme for a HDB flat purchase. This is different from being an owner or co-owner of the flat. An essential occupier does not have any legal right or a share in the apartment. A proper family nucleus can include:

- If married: you, your spouse, and your children

- If single: you and your parents

- If widowed, divorced, or separated: you and your children under your custody

- Orphaned siblings

- Fiancé and fiancée

And no, living in a HDB flat does NOT make you an essential occupier. Another thing to take note of: If you are listed as an essential occupier, you must continue to live in the HDB flat until the minimum occupation period is up.

Generally, many couples choose to include both couples’ names under a Joint Tenancy. However, some other couples choose to have their HDB apartments to be only under the name of 1 spouse. This could be the case provided if the couple only need 1 person’s income and CPF to finance the purchase of the EC. Thus, keep another name clean from house ownership in order to avoid ABSD when they buy 2nd property in the future under the said occupier.

Can I apply to change from Owner to Occupier?

According to HDB, it’s possible.

An HDB flat owner may change the flat ownership to his/her immediate family members such as spouse, parents, children, or siblings if it is due to reasons acceptable by HDB.

But not easy unless you have a valid, strong reasons. Citing reason of to purchase another private property will highly likely fail to get approval. So please plan it at the beginning before the purchase.

The biggest problem laying for occupier is that – if the relationship not going well, i.e divorce, there’s no legal right protection to the occupier.

Special About EC!

The above are general for HDB on the owner and occupiers, sounds rigid and disappointing policy to stay flexible right? ^_^

Good news is that for the EC, it will become privatised (half) after 5 Years MOP!

What implies is that, you can do “Decoupling” after 5 years MOP to take out one of the names.

Decoupling can only happens to private property, not HDB.

Decoupling basically is one party (say party A) take over and other party’s share (say party B) in the property, thus party A become 100% sole owner of the property, while party B become free from property. Party B can now purchase another property without incurring ABSD.

Currently, the legal fee for decoupling process is around $5,500 (i.e buy and sell), and the ownership transfer can be done as fast as 2 to 3 days. However, if the party B intend to use the sales proceed / CPF for the next purchase, then you should buffer about 3 months in order to see your CPF back into your account ready for next purchase.

So what’s the recommendation for EC Purchase?

Our best recommendation is that, buy under Tenancy in Common of 99% (A) and 1% (B). This will allow the income source eligibility and CPF usage from both persons to finance/ service the mortgage of the EC.

After 5 Years MOP, if you’re ready to purchase another property, then decoupling the property, i.e A can take over the B’s share in the property easily in a much negligible cost (compare to ABSD to be paid). Do feel free to contact us for a free calculation to understand your financial better for before and after decoupling.

Am I Eligible for Housing Grant? And How Much?

Under the CPF Housing Grant Scheme, you may be eligible to receive a housing subsidy of up to $30,000 when you buy an Executive Condominium (EC) unit from a property developer.

Depending on the household incomes (both applicants and occupiers), the amount of the grants varies:

First-timer households

First-timer and second-timer couples

Citizen Top-Up (for SC/ SPR households)

You may apply for the Citizen Top-Up of $10,000 when a qualifying member of your SC/ SPR household obtains Singapore citizenship. You must submit your application to HDB within 6 months of being eligible for it.

The CPF Housing Grant can be used to:

- Offset the purchase price of the EC unit

- Reduce the housing loan required for the EC unit purchase

If your household is eligible for the CPF Housing Grant, all members of the core family nucleus will receive equal shares of the grant. It will be fully credited into the CPF Ordinary Accounts of SCs and SPRs.

Note: Only core applicants can use their housing grants to pay for the EC unit purchase.

Read more the latest changes of EC regulations for Grants, Income Accessibility and Resale Levy.

What’s The Latest Monthly Household Income Ceiling?

The total income of all persons listed in the EC application must not exceed $16,000.

You will be guided by the property developer on the submission of documents, such as income documents, when you book an EC unit.

Read more the latest changes of EC regulations for Grants, Income Accessibility and Resale Levy.

Wait-Out Period for Ex-Private Condo/ EC Owners, or after Cancellation of BTO/ EC purchase.

Ownership in a private property means:

You have acquired a property through purchase or when it is:

• Acquired by gift;

• Inherited as a beneficiary under a will or from the Intestate Succession Act; or

• Owned, acquired, or disposed of through nominees.

If it’s a Private residential property

All applicants and occupiers listed in the EC application:

• Must not own or have an interest in any local or overseas private property; and

• Must not have disposed of any private property in the last 30 months before the EC application.

If it’s a Non-residential property

For EC land sales launched on or after 9 May 2023 (including those where the tenders have not closed) all persons listed in the EC application can, as a household, own up to 1 non-residential property at EC application and up to 30 months before EC application.

Note:

A private residential property includes but is not limited to a house, building or land that is under a residential land zoning (including land with multiple land zoning[1]), Executive Condominium (EC) unit, privatised HUDC flat and mixed use development[2].

Non-residential property is a property under a non-residential land zoning and/ or the permitted use does not include housing.

[1] E.g., residential with commercial at 1st storey or commercial and residential

[2] E.g., properties with a residential component, such as HDB shop with living quarters.

Cancellation of application after booking a flat from HDB

If you have booked a flat from HDB and subsequently cancel your flat booking, you must wait out a 1-year period from the date of the cancellation before you may apply or be listed as a core occupier to buy an EC unit from a property developer.

Termination of the Sale and Purchase Agreement for an EC unit

If you had previously bought an EC unit from a property developer with a CPF Housing Grant and subsequently terminated the Sale and Purchase Agreement, you must wait out a 5-year period from the date of the termination before you may apply or be listed as a core occupier to buy an EC unit from a property developer.

Owners/ Ex-owners of an EC unit bought from a property developer

If you currently own or have recently disposed of your ownership in an EC unit, you must wait out a 30-month period from the date of disposal of the EC unit before you may apply or be listed as a core occupier in an application to buy another EC unit from a property developer, subject to other eligibility conditions.

I Am Bankruptcy, Can I Still Purchase EC?

Prior consent must be obtained from the Official Assignee (OA) or the private trustee for the purchase of an EC unit.

You do not need to seek prior consent from the OA or the private trustee if you are listed as an occupier of the EC unit.

Do I Need to Pay Resale Levy? How Much?

The resale levy is meant to reduce the housing subsidy on the household’s (i.e, core applicants and core occupiers) second subsidised flat. This ensures a fairer allocation of housing subsidies among flat buyers.

If you and/ or any core applicants or core occupiers have taken a housing subsidy, you are considered a second-timer^. All second-timer core applicants and core occupiers will need to pay their respective resale levies, if applicable, when buying an EC unit from the property developer.

- A flat bought from HDB

- A resale flat bought with CPF housing grant

- A Design Build and Sell Scheme (DBSS) flat bought from a property developer

- An Executive Condominium (EC) unit bought from a property developer

- Other forms of housing subsidy (e.g. enjoyed benefits under the Selective En bloc Redevelopment Scheme (SERS), privatisation of HUDC estate etc.)

If you do not intend to buy a second subsidised flat from HDB, i.e., you are buying a resale flat or private residential property, you need not pay the resale levy.

If you and/or any core applicants or core occupiers have taken 2 housing subsidies, you are not eligible to apply or be listed as a core occupier in an EC application.. A subsidised housing is:

Payment of resale levy

The resale levy payable is determined at the point you book your second subsidised flat. It applies regardless of ownership type (joint-tenancy or tenancy-in-common) or shared interest in the flat. Payment must be made using your flat sale proceeds and/or cash. HDB housing loan will not be extended to the payment of a resale levy.

When and how payment is made

Subsidised flat sold on or after 3 March 2006

If you have sold your first subsidised flat from 3 March 2006 onwards, you will pay a fixed amount resale levy as follows:

Subsidised flat sold before 3 March 2006

If the first subsidised flat was sold before 3 March 2006, a percentage graded resale levy will apply (see table for more details).

If you have opted to defer the payment of the resale levy until you buy another flat from HDB, an interest at a prevailing rate of 5% per annum is charged.

* Only applicable to 2-room flat sellers who buy a larger flat type.

If you and your spouse are aged 55 and above, have sold your first subsidised flat before 3 March 2006 and right-sizing to a new 3-room or smaller flat, you will pay only the percentage graded resale levy, with the interest waived. The resale levy payable is also subject to a minimum amount of $15,000 for 2-room, $30,000 for 3-room, $40,000 for 4-room, $45,000 for 5-room, and $50,000 for Executive flat sold. These are the same resale levy amounts payable by second-timers who sold their first subsidised flat on or after 3 March 2006.

If you have any questions about the amount of resale levy payable, you may contact us via e-Feedback form.