Navigation Guide

Ultimate Guide for Buying Property in Singapore (Local vs Foreigner)

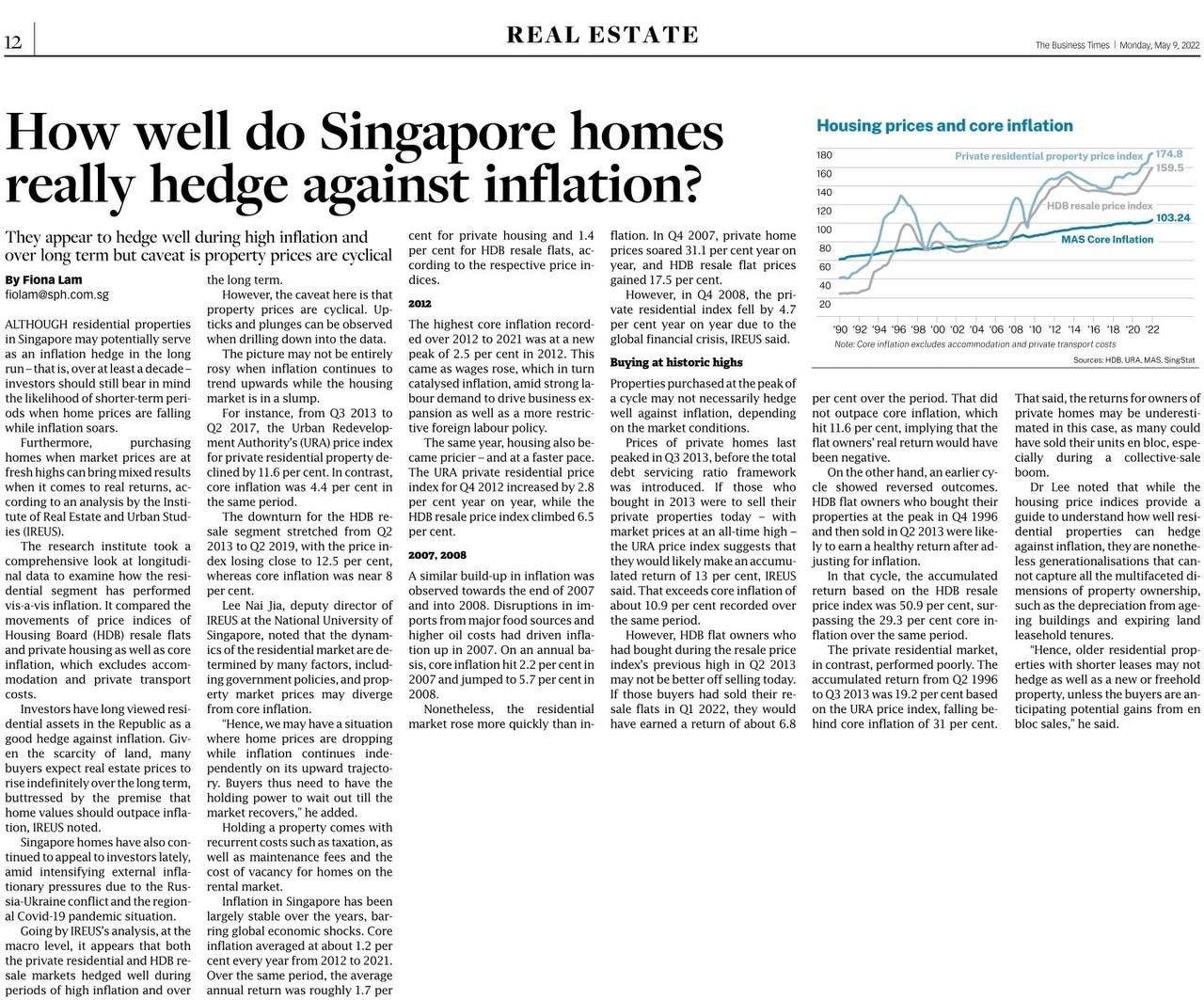

In cities such as Singapore and Hong Kong, property is a hot button topic with keen interest from both local and foreign buyers. Traditionally, it is also considered one of the safest forms of investments for people to grow their money

The Singapore Government keeps a close watch on the local property market. While homeowners, property investors and developers have been directly impacted by the different rounds of cooling measures, it is common knowledge that such initiatives are in place to prevent overexuberance in the industry and the danger of a property bubble forming.

There are many compelling reasons that make Singapore a lucrative choice for property investment, it is no surprise that Singapore’s properties well received by foreigners, be it for investment, holidays home, children education…etc. We think here are the top 3 reasons:

Firstly, Singapore’s property market is established upon stable political governance, sound economic policies and Singapore’s indisputable position as a commercial trading hub. The local property market is also closely monitored by the Singapore government and initiatives to prevent the formation of a property bubble are well-established. Therefore, foreign investors are assured that the value of their investment in local property will be maintained for years to come.

Secondly, Singapore’s pro-business and low-tax environment has helped put Singapore on the radar for property investment amongst foreigners. Despite the introduction of the Additional Buyer’s Stamp Duty, the cost will be partially offset by the non-existence of capital gains and inheritance taxes. Additionally, when selling property, the only chargeable tax is the Seller’s Stamp Duty (SSD), which is not only applicable within the first three years but is also relatively low.

Thirdly, the strength of the Singapore dollar can help shield part of one’s portfolio from political instability, thereby offering investors an opportunity for diversification.

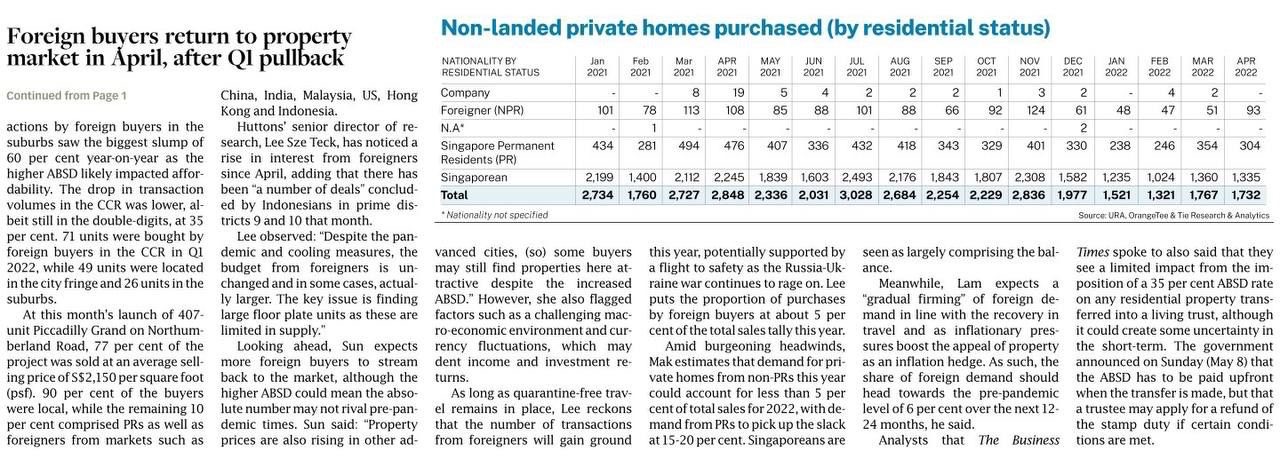

With the border reopening, we had seen an increasing numbers of foreigner buyers coming back to Singapore property market. If you’re foreigner considering buying property in Singapore, this article is right for you!

Who are Foreigner?

A foreign person means any person who is not any of the following:

- Singapore citizen;

- Singapore company;

- Singapore limited liability partnership; or

- Singapore society.

Simply put, you’re considered a foreigner if you are not a Singapore citizen, a Singapore company, a Singapore limited liability partnership or a Singapore association. As such, Singapore Permanent Residents (SPRs) are also considered foreigners.

Singapore Permanent Residents (SPRs) will enjoy lower rate of taxes and also less restrictions to buy, e.g public housing (resale HDB flats/ Executive Condominiums), and landed house (with approval from Singapore Land Authority), which we will elaborate more in the following respective sections.

What types of properties a foreigner can and can’t buy?

Under the Residential Property Act, a foreigner can buy both public housing and private properties. However, there are restrictions on what foreigners can and can’t buy.

There’s a long answer to this question, but the short one is that foreigners can largely buy the following property types in Singapore:

- Most condos;

- Some strata landed houses;

- Landed houses on Sentosa;

- An executive condominium that is more than 10 years old.

Let’s getting into more details of each type of housing available in Singapore.

1. Public HDB Flats

Public Housing Development Board (Public HDB) flats, are built with the intention of making affordable housing available to the ordinary Singaporean. Therefore, they are heavily subsidized and regulated by the government and buyers can further obtain housing grants to fund the purchase. However, Public HDB flats come with strict eligibility requirements that must be met, including forming family nuclear with Singaporean/ SPR, household income ceiling, requirement to dispose all properties in Singapore & overseas…etc.

If you’re foreigner buying alone, you can forget about this.

2. Executive Condominium (EC)

Executive Condominium (EC) is a special segment introduced by government. It’s aim to cater the demands of Singaporeans who wish to upgrade to condominium living and yet able to afford the price of a private condo. EC is as good as private condo built by private developers but having huge subsidised from government. Typically it about 15-25% lower price than a private condominiums in the market. Thus, the restriction / eligibility to buy is similar to buying a HDB.

Many Singaporeans are making this as a “stepping stone” to upgrade to private condominiums in their young age, and make their first pot of gold. But come to reality, the buying eligibility, household income restriction and bank loan eligibility are always the bottleneck to put them to a stop.

After 5 years, the EC can be bought by SPR in open market without restrictions, but non-SPR foreigner still not eligible to buy. That’s what we call it “Half Privatised EC”. After 10 years, the EC will reach another milestone – “Fully Privatised EC”. This means the EC now become a private condo status, and can be bought by non-SPR as well.

If you’re SPR buying alone, you can buy EC that is more than 5-years. If you’re non-SPR foreigner buying alone, you can only buy EC that is more than 10-years after it’s fully privatised.

1. If you’re a non-Singapore Permanent Resident (SPR) buying alone:

You can only buy a private executive condominium (EC) that is more than 10 years old.

2. If you’re a Singapore PR buying alone:

Apart from new HDB flats, Singapore PRs can’t buy a resale HDB flat alone, and can only buy resale ECs that have reached their 5-year Minimum Occupation Period (MOP).

3. If you’re a Singapore PR jointly buying with another Singapore PR:

- A resale HDB flat (3 years after obtaining your PR)

- A resale EC that is more than five years old

- A privatised EC that is more than 10 years old

4. If you’re a Singapore PR buying with a non-Singapore PR:

- A resale EC that is more than five years old

- A privatised EC that is more than 10 years old

5. If you’re jointly buying as a non-Singapore PR couple

- A privatised EC that is more than 10 years old

3. Private Properties

Unlike public housing, private properties have lesser restrictions and are a foreigner typically be more favourable in buying in Singapore. They also come with better fittings, designs and are generally closer to the Central Business District (CBD). If you’re buying a private condominium, they also come with facilities such as swimming pools, gyms, saunas, and more.

Here are the common property types that foreigners are eligible to buy:

– Condominium unit;

– Flat unit;

– Strata landed house in an approved condominium development;

– A leasehold estate in a landed residential property for a term not exceeding 7 years, including any further term which may be granted by way of an option for renewal;

– Commercial-use shophouse;

– Industrial and commercial properties; Hotel (registered under the provisions of the Hotels Act); and

– Executive condominium unit, HDB flat and HDB shophouse.

The following properties require approval to purchase:

– Vacant residential land;

– Terrace house;

– Semi-detached house;

– Bungalow/detached house;

– Strata landed house which is not within an approved condominium development under the Planning Act (eg. townhouse or cluster house);

– Shophouse (for non-commercial use);

– Association premises;

– Place of worship; and

– Worker’s dormitory/serviced apartments/boarding house (not registered under the provisions of the Hotels Act).

| What Singapore PRs can buy | What non-Singapore PRs can buy |

| Resale HDB flats (with another Singapore PR or Singaporean) | Private condos |

| Resale ECs that has reached their 5-year MOP | Private ECs |

| Privatised ECs | Landed properties in Sentosa Cove |

| Private condos | Landed properties (with special permission from Singapore Land Authority) |

| Strata-landed homes | |

| Landed properties in Sentosa Cove | |

| Landed properties (with special permission from Singapore Land Authority |

How much the Buyer Stamp Duty (BSD), ASBD foreigner have to pay when buying property in Singapore?

Buyer Stamp Duty (BSD) a Requirement for all Property Buyers

The Buyer Stamp Duty (BSD) is a tax levied on all property buyers regardless of nationality who purchase any property and it is dependent on the purchase price or market value of the property (the ‘Base’). Generally, the more expensive the purchase price or market value of the property, the higher the BSD Rate.

| Purchase Price | BSD Rates |

| First $180,000 | 1% |

| Next $180,000 | 2% |

| Next $640,000 | 3% |

| Remaining Amount (only for residential properties) |

4% |

Additional Buyer Stamp Duty (ABSD)

The Additional Buyer Stamp Duty (ABSD) is a tax levied on the purchase of residential property and is in addition to the BSD and is only applicable to the following buyers:

– A Singapore citizen who already has ownership of a residential property and wishes to acquire another;

– A Permanent Resident; or

– A Foreigner.

Essentially, the ABSD affects everyone except Singapore Citizens who are buying their first property.

| Profile of Buyer | ABSD Rates (Effective from 16 Dec 2021) |

|---|---|

| Singapore Citizens (SC) buying first residential property | Not applicable |

| SC buying second residential property | 17% |

| SC buying third and subsequent residential property | 25% |

| Singapore Permanent Residents (SPR) buying first residential property | 5% |

| SPR buying second residential property | 25% |

| SPR buying third and subsequent residential property | 30% |

| Foreigners (FR) buying any residential property | 30% |

| Entities buying any residential property |

35% |

| Housing Developers buying any residential property |

35% (Plus Additional 5% (non-remittable)) |

From 9 May 2022 onwards, any transfer of residential property into a living trust will be subject to an ABSD rate of 35%.

| Profile of Buyer | ABSD Rates on or after 9 May 2022 |

|---|---|

| Trustee buying any residential property | 35% |

Special Case: If you are a foreigner or Permanent Resident with a Singaporean spouse and both of you do not own any residential property in Singapore, the ABSD will be waived as first matrimonial home. It can also be refunded if you are switching your first matrimonial home as a married couple. However, the existing property must be sold within six (6) months after the date of purchase of the second property (if completed); or ii) Temporary Occupation Permit (whichever is earlier).

Foreigners Eligible for ABSD Remission under Free Trade Agreements (FTAs)

Good news if you are Nationals of the United States of America, or Nationals/ PR of Iceland, Liechtenstein, Norway and Switzerland!

Under the respective FTAs, Nationals or Permanent Residents of the following countries will be accorded the same Stamp Duty treatment as Singapore Citizens:

- Nationals and Permanent Residents of Iceland, Liechtenstein, Norway or Switzerland

- Nationals of the United States of America

You will be granted the same tax treatment as Singapore Citizens. Therefore, the ABSD will be not be applied on your first residential purchase and your second, third & subsequent residential purchases will be taxable at 17% and 25% respectively.

What is the property taxes a foreigner have to pay?

Property tax is a wealth tax levied on property ownership. It is not a tax on rental income. It is thus levied on the ownership of properties, irrespective of whether the property is occupied or vacant.

The property tax is calculated by multiplying the Annual Value (AV) of the property with the prevailing property tax rate.

Every property has an AV. This AV of a property is determined based on market rentals of similar or comparable properties. What this means is that if you own a five-room flat in Toa Payoh, the Inland Revenue Authority of Singapore (IRAS) looks at similar five-room flats in Toa Payoh and how much they are rented out at, to determine the Annual Value, i.e monthly rental x 12 months.

The annual property tax is calculated by multiplying the Annual Value (AV) of your property by the appropriate property tax rate. The formula looks like this:

Annual Value (AV) ✕ Property tax rate = Property tax payable

The AV of a property might vary from year to year, so will your property taxes. It’s worth noting that when areas get new amenities and rental prices go up, so will your AV and property tax. Similarly, when the market is down, your AV will go down too, and along with it the amount of property tax you have to pay.

Whenever your AV has changed, the Inland Revenue Authority of Singapore (IRAS) will send you a notification regarding the revision. You can also log in to the IRAS myTax Portal to check on the AV of your property any time.

If your AV is reassessed, and you disagree with it, you can submit an objection. You should do so within 30 days from the date of the valuation notice. You cannot however object the tax rate itself.

If you wish to view the AV of a property before buying it, you can do so with the Check Annual Value of Property service. Take note that each search costs S$2.50 inclusive of GST.

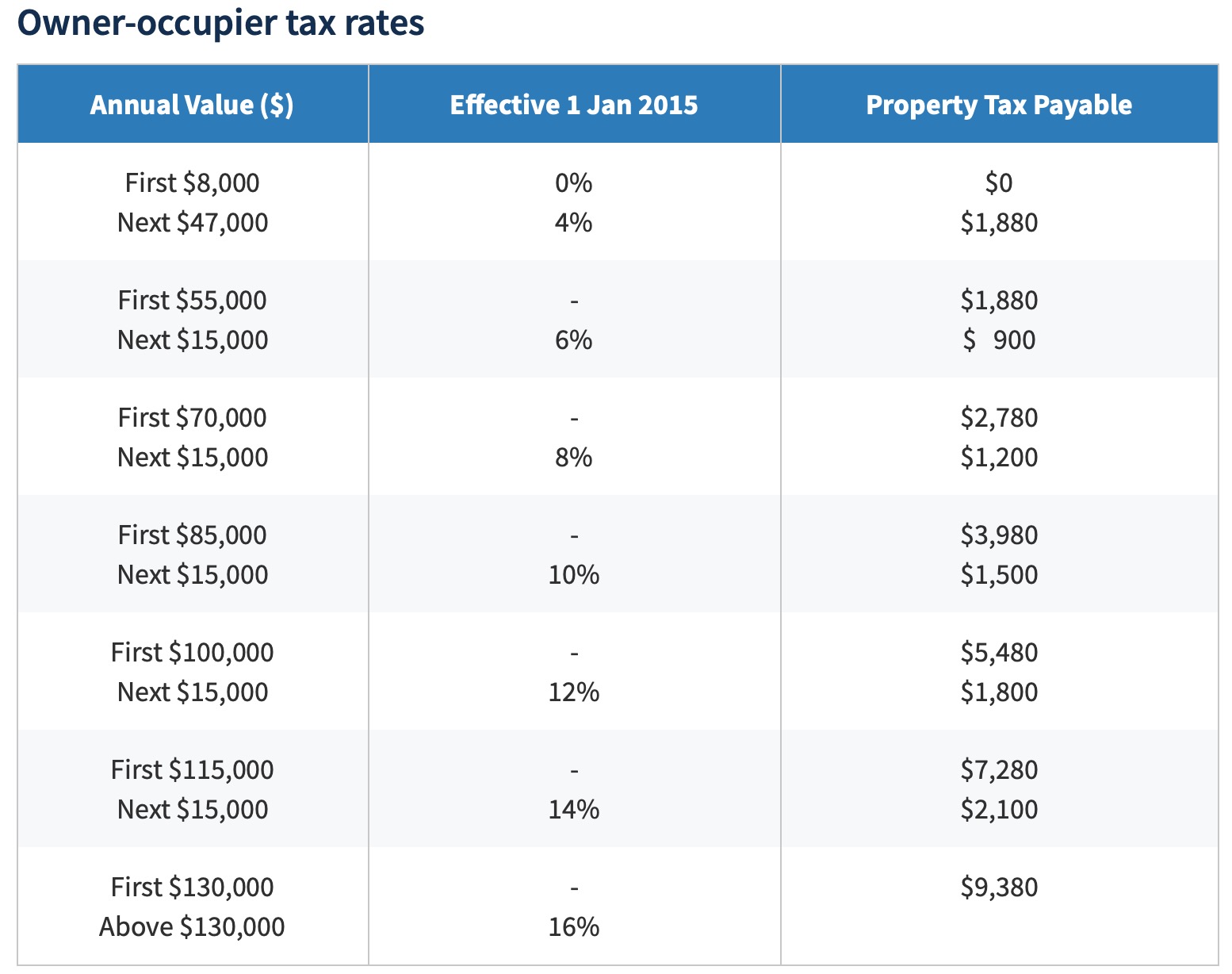

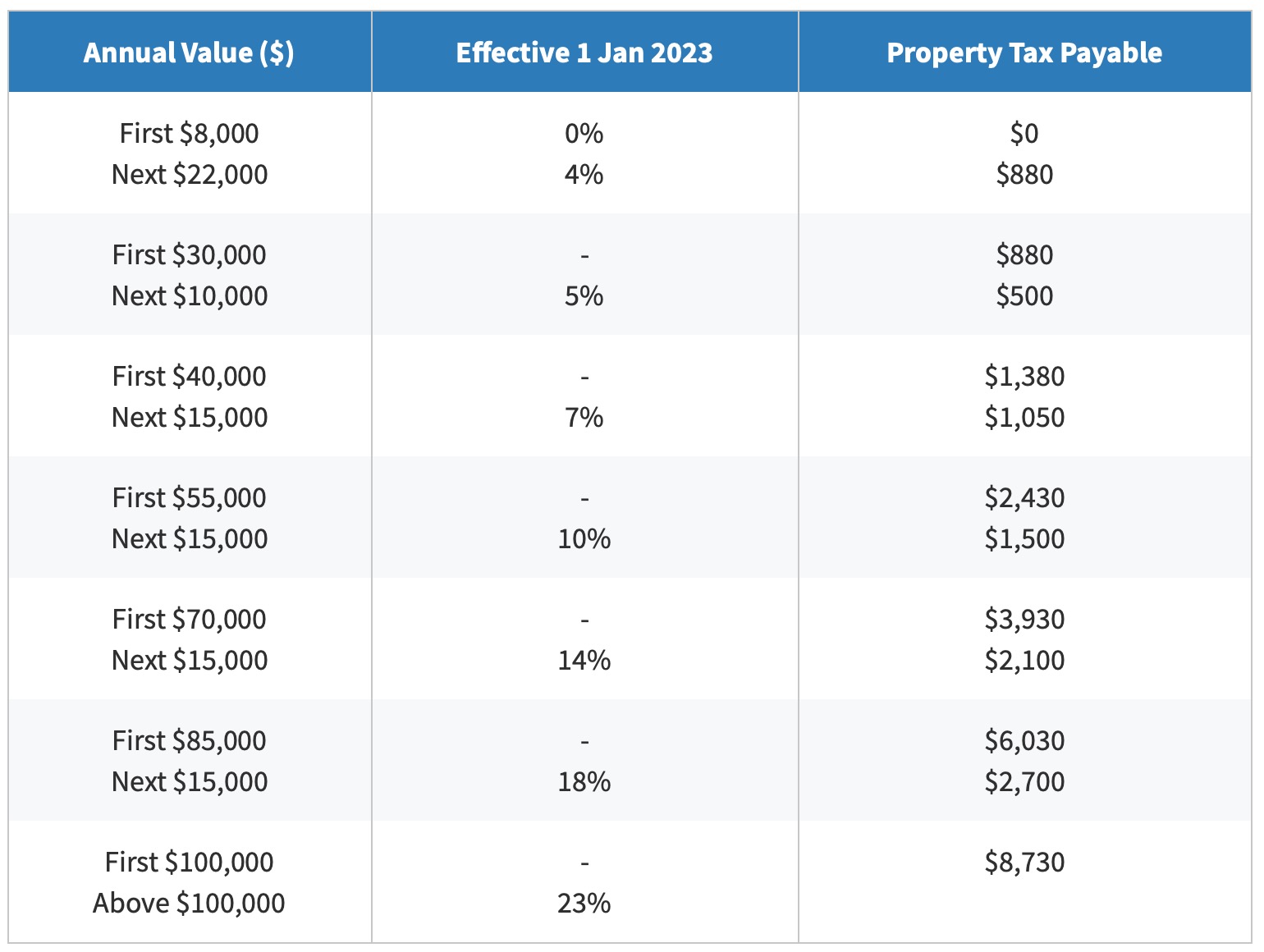

Property tax rate

Your tax rate is dependent on factors such as your Annual Value and whether you live in the property yourself. Basically, the higher the AV of your home, the higher the tax rate. The idea is to tax the wealthy more. Hence, properties that are not owner-occupied have a higher progressive tax rate. This is logical as those who own property they don’t live in (whether it’s rented out or vacant) are deemed to be wealthier.

Following the latest announcement on Singapore Budget 2022, property tax will be adjusted marginally in two steps, i.e in 2023 and 2024. The real impact on this increment will be the luxury property segment, which they have a very high AV. For reference, a Good Class Bungalow had hit S$200,000 rental per month, or S$2.4mil a year.

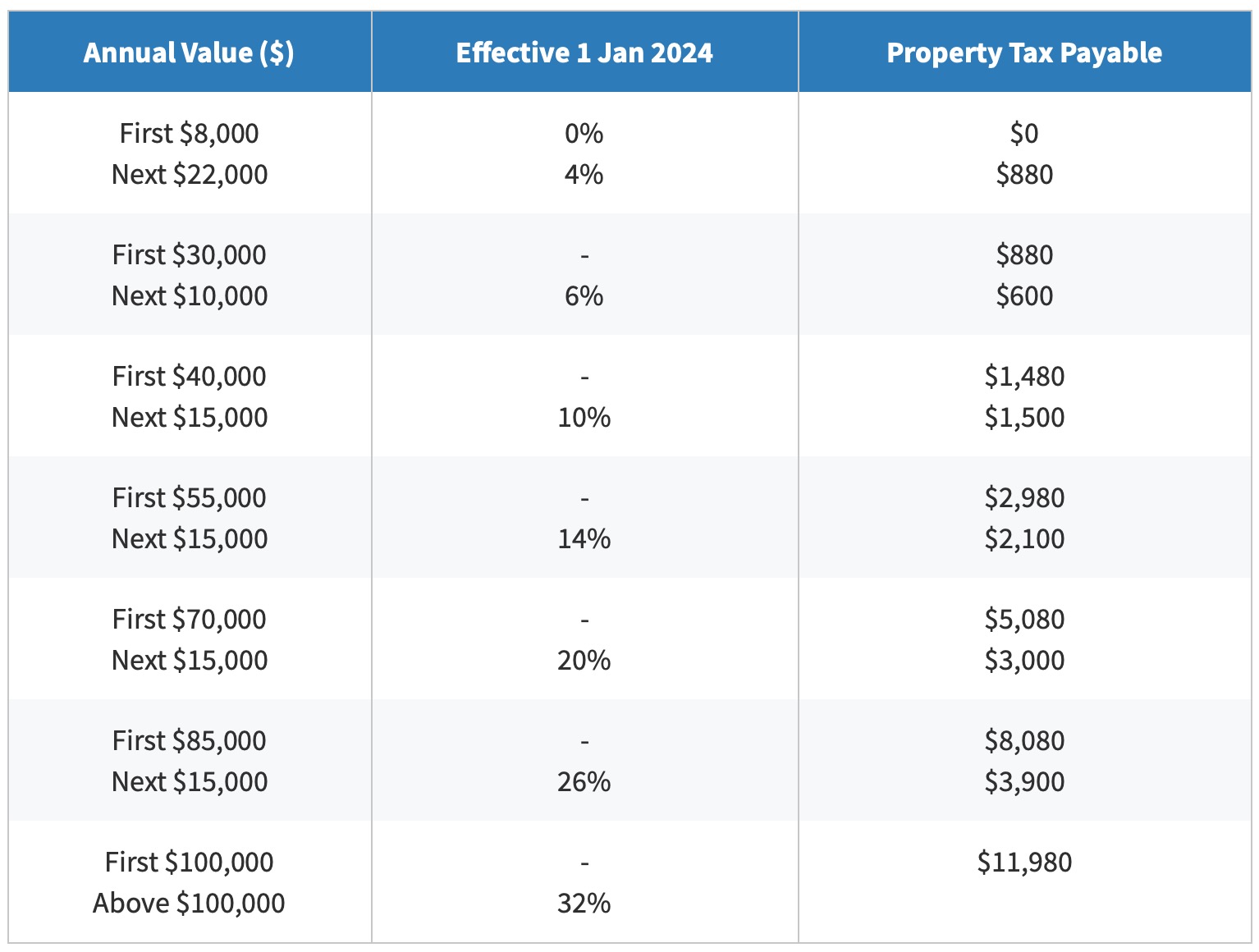

Owner-occupier tax rates

Let’s get down to the numbers. If you are an owner-occupier, the following tax rates apply to you.

In Singapore, owner-occupier property tax rates range from 0 to 32% eventually. As can be seen from the table, the owner-occupied homes with an AV of S$8,000 and below are exempted from paying property tax.

If the above table is a bit confusing, let us work out an example which tax rate you should use as an owner-occupier.

Before 2023, if your property’s AV is S$105,000 (i.e appraised monthly rental is about S$105,000/ 12months = S$8,750):

First S$100,000 = S$5,480

Remaining S$5,000: 12% = S$600

Total property tax payable: S5,480 + S$600 = S$6,080

Starting 1st Jan 2023,

First S$100,000 = S$8,730

Remaining S$5,000: 23% = S$1,150

Total property tax payable: S$8,730 + S$1,150 = S$9,880

Starting 1st Jan 2024,

First S$100,000 = S$11,980

Remaining S$5,000: 32% = S$1,600

Total property tax payable: S$11,980 + S$1,600 = S$13,580

Instead of doing manually, you can just use the property tax calculator on IRAS to calculate your property tax.

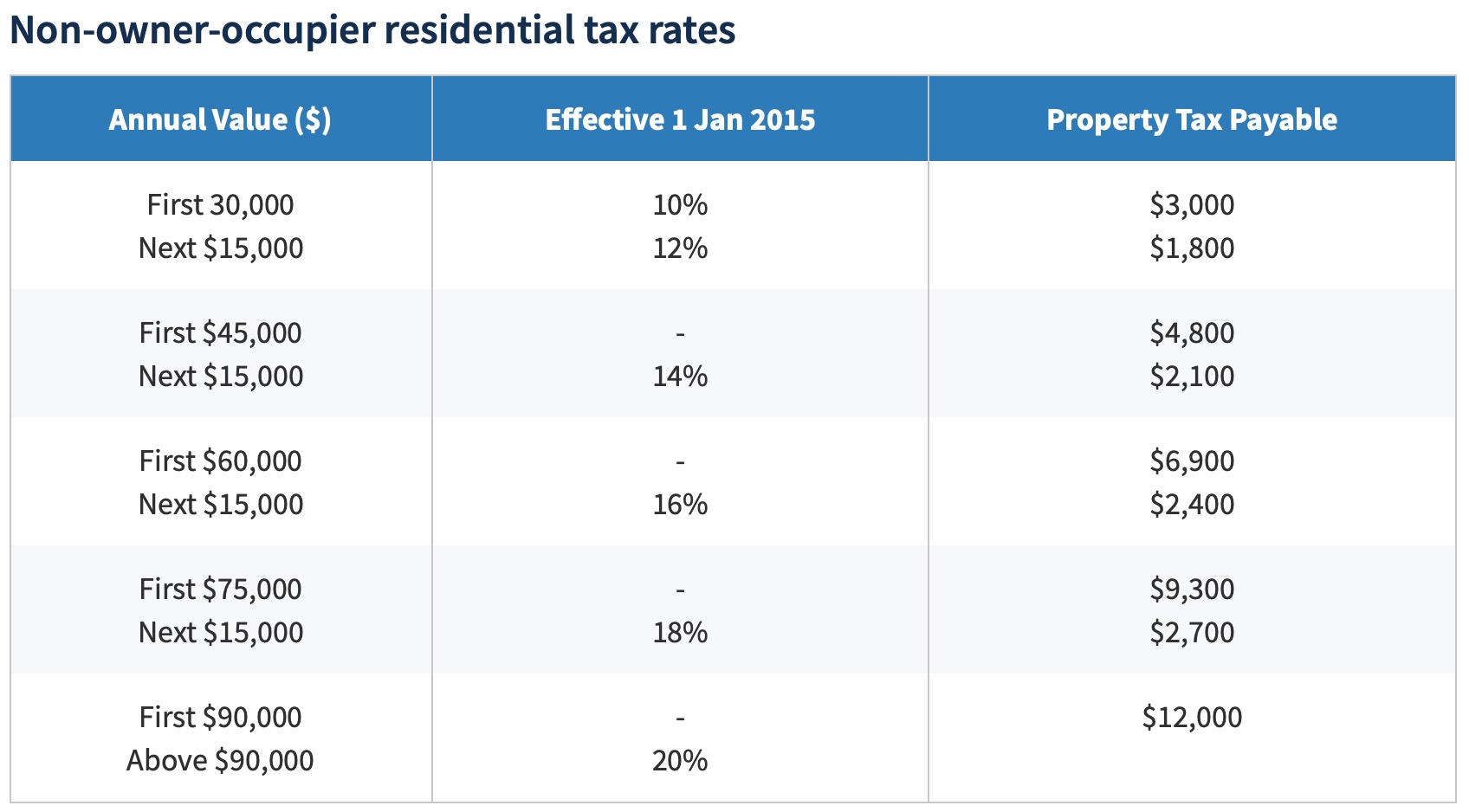

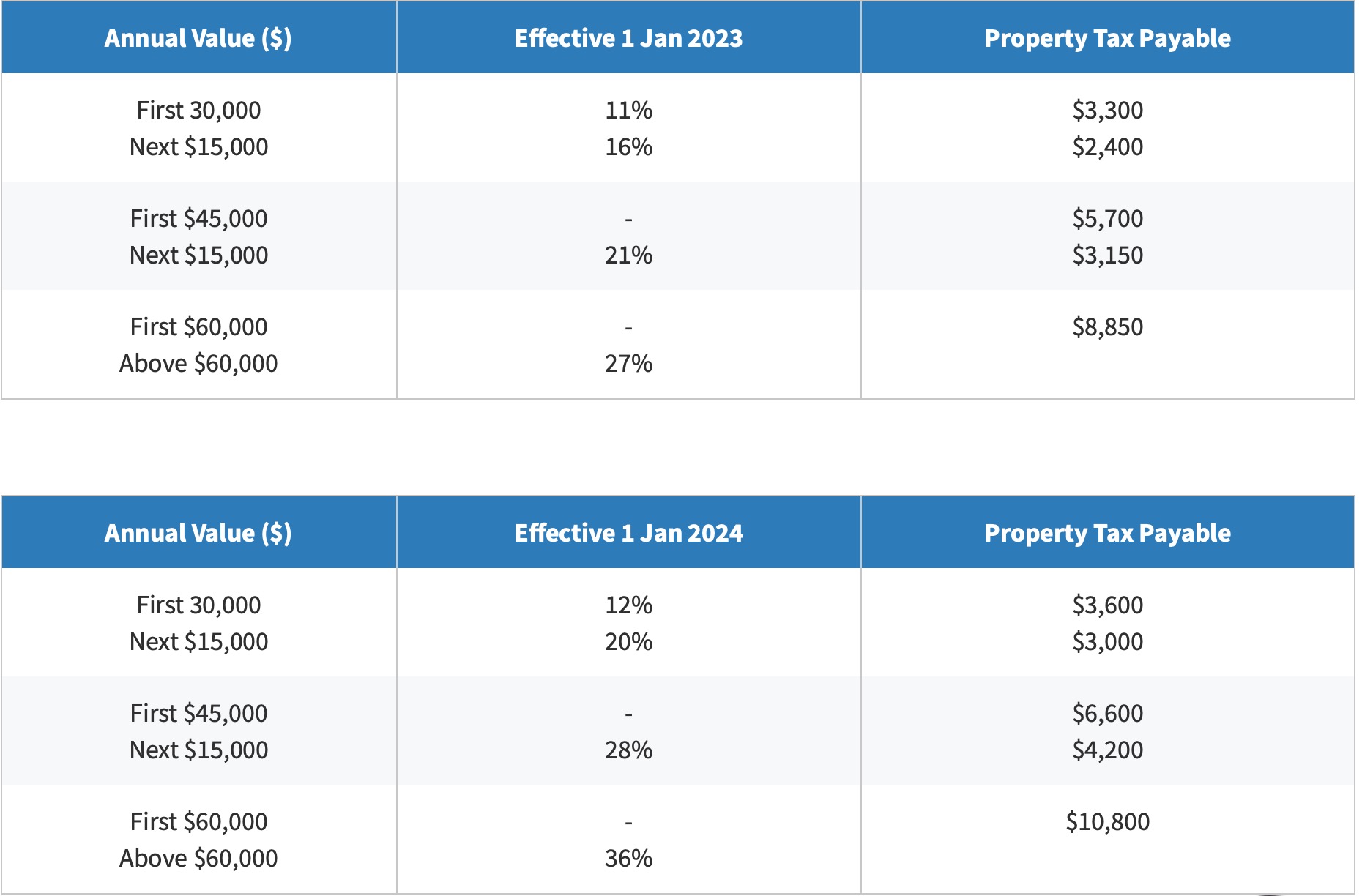

Non-owner-occupier tax rates

If you own property within which you do not reside yourself (be it rented out or vacant), then these higher tax rates apply to you, the non-owner-occupier.

Non-owner-occupier property tax rates range from 10 to 36% eventually. In case you’re wondering if you can be the owner-occupier of two homes, the answer is no, you can only be listed as the owner-occupier in one home.

And don’t try to outsmart IRAS. For a married couple who choose to decouple and own two properties under individual names, the owner-occupier tax rates will still only apply to ONE property.

On a more sombre note, a property owned by a person who is deceased is technically considered a non-owner-occupied property. However, IRAS will apply owner-occupier tax rates for an extended period of up to either two years from the owner’s passing or the date of transfer of the property, whichever is earlier. Further requests for extension may be submitted on appeal.

A person who owns both an HDB and a private property, and rents out the private property while still claiming that they live there as an owner-occupier, may be subject to investigation and prosecution if they are found to be deliberately falsifying information to avoid a higher tax.

In any case, once you have rented out a property, IRAS will know because the stamp duty of the rental has been paid. The owner-occupier tax rates are no longer applicable for that property from the date of rental.

Commercial and industrial properties (Non-Residential)

Non-residential properties such as commercial and industrial buildings and land are taxed at 10% of the Annual Value. Owner-occupier tax rates do not apply to non-residential properties even if you have bought the properties for your own use/occupation.

Property tax in Singapore is due on 31st January every year.

In the event that you are late, a 5% penalty is imposed on the unpaid tax. If you have submitted an objection and are still waiting for the outcome, you’ll still have to pay the tax. If there’s any revision, you’ll be refunded for the excess payment.

In the event that you have failed to pay tax even after the penalty has been issued, IRAS can appoint agents like your bank, employer, tenant or lawyer to recover the overdue tax. Worse still, they may put up your property for auction to recover the unpaid tax.

How much the rental income taxes payable in Singapore for foreigner?

Be it you are foreigner or local, everyone have to pay “Income Tax”.

Property tax is imposed based on ownership of property, while income tax is being taxed on the rental income earned. Hence, you are not being taxed twice for ownership of property.

The tax rate for non-resident individuals is currently at 22%. It applies to all income including rental income from properties, pension and director’s fees, except employment income and certain income taxable at reduced withholding rates (please see Withholding taxes on income of non-resident individuals below). For more info, refer to IRAS: Individual Income Tax Rate

New! From YA 2024, the income tax rate for non-resident individuals (except on employment income and certain income taxable at reduced withholding rates) will be raised from 22% to 24%. This is to maintain parity between the income tax rate of non-resident individuals and the top marginal income tax rate of resident individuals.

Good news is that only the net rental income after deduction of any allowable expenses is subject to income tax, i.e expenses incurred solely for producing the rental income and during the period of tenancy may be claimed as tax deduction, which including:

1. Bank loan interest

2. Property Tax

3. Fire Insurance

4. Repairs & Maintenance

5. Furniture

6. Management cost, utilities bill, internet bill etc.

Is there any taxes / capital gain tax/ inheritance tax when I sell off the property as foreigners?

Capital Gain Tax / Inheritance Tax

Good news! There are no capital gain tax or inheritance tax payable in Singapore, whether you are foreign or local. However, note that there is a Sellers Stamp Duty (SSD) aimed to prevent speculation. It only applies for three years, and affects foreigners and locals alike.

Seller Stamp Duty (SSD)

The seller pays stamp duty of 4% to 12% on transfers of residential properties, if disposed within 3 years of acquisition. The applicable stamp duty rate varies, depending on the holding period of the property. In most instances, the date of purchase/ acquisition of a property refers to:

-

-

- Date of Acceptance of the Option to Purchase* or

- Date of Sale and Purchase Agreement or

- Date of Agreement for Lease (for new HDB flat) or

- Date of Transfer where the above (a), (b) and (c) are not applicable

-

*Excludes an option to Purchase that is subject to the execution/ signing of the Sale and Purchase Agreement

| Holding Period | SSD Payable |

| Up to 1 year | 12% |

| More than 1 year and up to 2 years | 8% |

| More than 2 years and up to 3 years | 4% |

| More than 3 years | No SSD payable |

SSD is computed by applying the requisite SSD rate on the higher of the selling price or the market value of the residential property as at the date of sale or disposal.

A typical new launch construction period is 3-4 years time. For investors buying into new launches condo, the 3years SSD period will had passed before building is completed. Thus they can sell it without incurring SSD.

Can I apply bank loan from Singapore banks as foreigner, and how much I can loan?

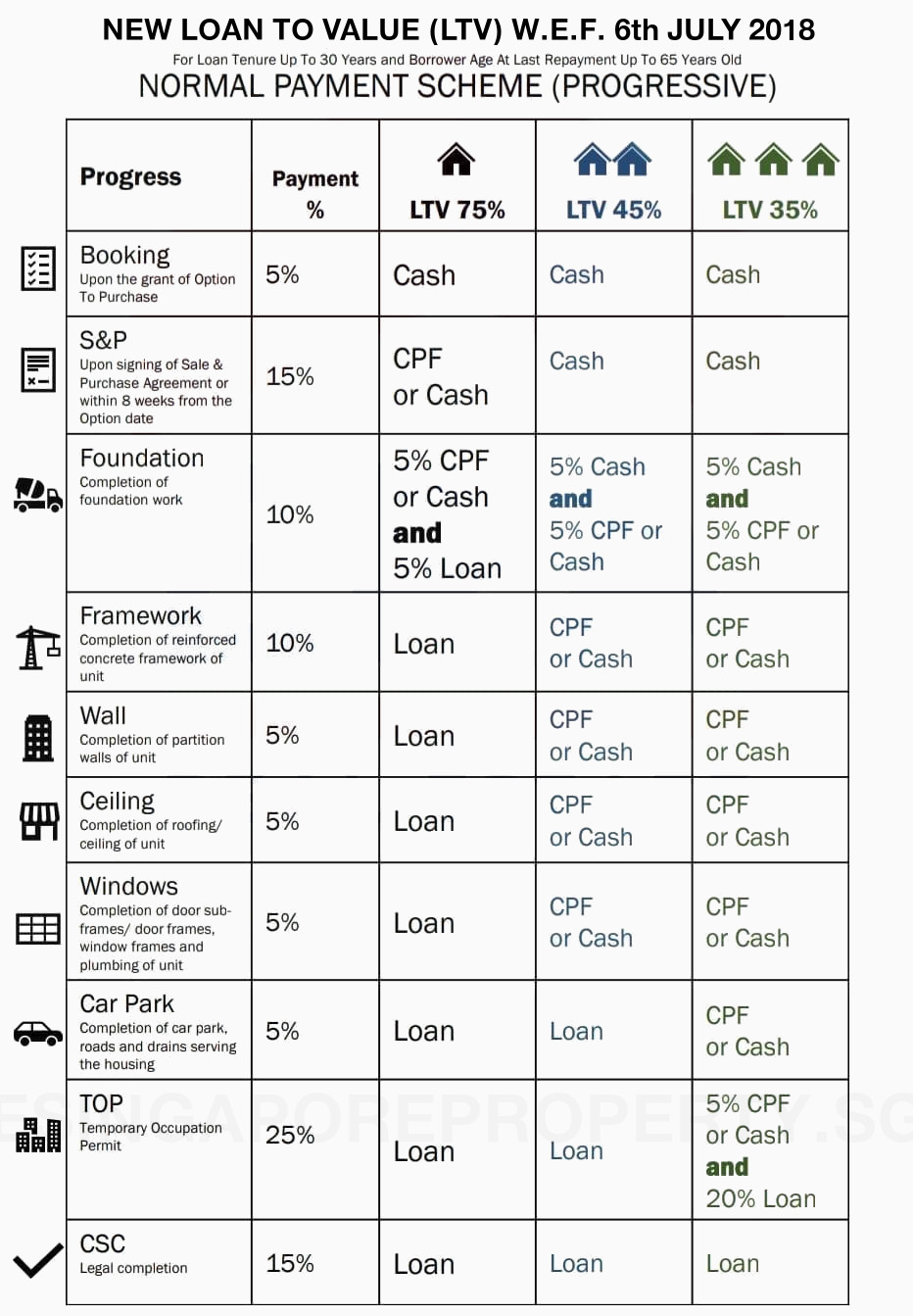

Yes. Foreigners can indeed apply for mortgages in Singapore. Regardless of nationality, there are limits on the loan to value (LTV) ratio of your mortgage, as well as mandated minimum cash downpayments. This is set by Monetary Authority of Singapore (MAS).

As for foreigner buying property in Singapore with income generated in overseas, you will face more stringent of requirements (e.g translation of documents / proof of sources of fund/ certified true copy) to secure the same LTV as local residents. If you’re working in an established company, e.g Multinational Company (MNC), it will help a lot too!

As part of the cooling measures in residential property market, the maximum loan to value ratio is 75% for a first home loan (but depending on your age and the tenure of your loan, it can be as low as 55%). The cash downpayment required is typically 5% (but, similarly, it can be as much as 10%). If you’re getting a 2nd or 3rd home loan in Singapore, the LTV will be significant reduced as illustrated by the following chart. This is to ensure a healthy debt ratio for every buyers, and prevent property bubbles forming.

Note that, commercial/ industrial property is not subjected to cooling measures, therefore the buyers do not need to pay ABSD and LTV for commercial property can be higher than 75% set for residential property.

In short, for foreigner (non-SPR) buying 1st residential property in Singapore, and assume that you manage to secure 75% bank loan, thus

The initial cash outlay within 8 weeks = 25% downpayment + Stamp duty (i.e 3~4%) + ABSD (i.e 30%), which is approximately 54% of property price.

You can use our all in one calculator to have an ideas how much you can loan, the downpayment required, mortgage instalment, or what’s the minimum income required for certain purchase price etc.

>> Singapore Bank Loan Eligibility Calculator

Where should I buy as a foreigner? What is CCR, RCR, OCR in Singapore?

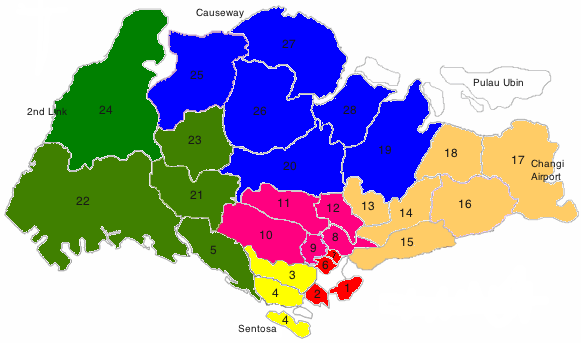

Depending whether you are buying the property for own stay or investment, location plays an important role. Properties in prime districts retain their value very well and they usually have the highest capital gain in a bullish property market. Properties in the suburbs are lower in price and may be more suitable for own stay than investment.

Let’s take a look the Singapore Map first:

Like many other countries, the countries is divided into “districts”. In Singapore, there are total 28 Districts in this small island. However the numbering of districts doesn’t represent the popularity or property price. For example, District 1 doesn’t means it’s more expensive district than District 2.

These districts are further categorised into 3 regions by Urban Redevelopment Authority (URA), i.e

- Core Central Regions (CCR)

- Rest of Central Regions (RCR)

- Outside Central Regions (OCR)

This is more meaningful term to define the prime areas/ property price range of Singapore. However, some districts are fall into the boundary of the region. Which means a same district could have areas belongs to 2 different regions. For example, part of the District 05 is within RCR, and the rest of it is OCR. The boundary defining RCR and OCR in District 05 is the Clementi Road.

The following table further elaborate each of the district and zoning.

| Zone | District | Postal Codes beginning with | Location |

| City/ CCR | 1 | 01, 02, 03, 04, 05, 06 | Boat Quay, Cecil, Havelock Road, Marina, People’s Park, Raffles Place, Suntec City |

| City/ CCR | 2 | 07, 08 | Anson, Shenton Way, Tanjong Pagar |

| South/ CCR & RCR | 3 | 14,15, 16 | Alexandra, Queenstown, Redhill, Tiong Bahru, Chinatown. [Boundary: Maxell Rd] |

| South/ RCR | 4 | 09, 10 | Harbourfront, Keppel, Sentosa, Telok Blangah |

| West/ RCR & OCR | 5 | 11, 12, 13 | Bouna Vista, Clementi, Dover, Hong Leong Garden, Pasir Panjang, West Coast. [Boundary: Clementi Rd] |

| City/ CCR & RCR | 6 | 17 | Beach Road (part), City Hall, High Street, North Bridge Road. [Boundary: Hill St.] |

| City/ CCR | 7 | 18, 19 | Beach Road, Bencoolen Road, Bugis, Golden Mile, Middle Road, Rocher. |

| Central/ RCR | 8 | 20, 21 | Farrer Park, Little India, Serangoon Road |

| Central/ CCR | 9 | 22, 23 | Cairnhill, Killiney, Orchard, River Valley |

| Central/ CCR | 10 | 24, 25, 26, 27 | Ardmore, Balmoral, Bukit Timah, Grange Road, Holland Road, Orchard Boulevard, Tanglin |

| Central/ CCR | 11 | 28, 29, 30 | Chancery , Dunearn Road, Moulmein, Newton, Novena, Thomson, Watten Estate, Novena |

| Central/ RCR | 12 | 31, 32, 33 | Balestier, Toa Payoh |

| East/ RCR | 13 | 34, 35, 36, 37 | Braddell , Macpherson, Potong Pasir |

| East/ RCR | 14 | 38, 39, 40, 41 | Eunos, Geylang, Kembangan, Paya Lebar, Sims |

| East/ RCR & OCR | 15 | 42, 43, 44, 45 | Amber Road, East Coast, Joo Chiat, Katong, Marine Parade, Meyer, Tanjong Rhu. [Boundary: Still Road] |

| East/ OCR | 16 | 46, 47, 48 | Bayshore, Bedok, Chai Chee, Eastwood, Kew Drive, Upper East Coast |

| East/ OCR | 17 | 49, 50, 81 | Changi, Flora, Loyang |

| East/ OCR | 18 | 51, 52 | Pasir Ris, Simei, Tampines |

| North/ RCR & OCR | 19 | 53, 54, 55, 82 | Hougang, Punggol, Sengkang, Serangoon Garden. [Boundary: Bartley East Road] |

| North/ RCR & OCR | 20 | 56, 57 | Ang Mo Kio, Bishan, Braddell, Thomson. [Boundary: Ang Mo Kio Ave 1] |

| West/ RCR & OCR | 21 | 58, 59 | Clementi Park, Hume Avenue, Ulu Pandan, Upper Bukit Timah, Beauty World. [Boundary: PIE & Upper Bukit Timah Rd] |

| West/ OCR | 22 | 60, 61, 62, 63, 64 | Boon Lay, Jurong, Tuas |

| West/ OCR | 23 | 65, 66, 67, 68 | Bukit Batok , Bukit Panjang, Choa Chu Kang, Dairy Farm, Hillview |

| West/ OCR | 24 | 69, 70, 71 | Lim Chu Kang, Sungei Gedong, Tengah |

| North/ OCR | 25 | 72, 73 | Admiralty Road, Kranji, Woodgrove, Woodlands |

| North/ OCR | 26 | 77, 78 | Springleaf, Tagore, Upper Thomson |

| North/ OCR | 27 | 75, 76 | Admiralty Drive, Sembawang, Yishun |

| North/ OCR | 28 | 79, 80 | Seletar, Yio Chu Kang |

Traditionally, based on the statistics, the wealthy foreigners are mostly buying in prime districts like district 09, 10, 11 or the Central Business District (CBD). They want the best of the best in Singapore.

With the property prices in Singapore getting highly appreciated over the years and the hike in taxes for foreigner buying property in Singapore, there is increasing number of foreigners buying into city fringe areas, where they could enjoy a lower entry price and yet still close to CBD. Properties with sea view at the East Coast are also highly in demands as a resort home or investment.

To spell a few the most popular (and priciest) locations where wealthy foreigners are likely to look into:

Orchard

Orchard Road is always buzzing with activity and is literally the heart of Singapore. From upscale shopping centers to restaurants that promise a gastronomic dining experience, everything that you ever need is right at your doorstep. The centrality of the location also provides access to excellent public transport links and places you in close proximity to the Central Island Expressway and Central Business District. Living in the area may come with a hefty price tag but you can be assured that the advantages of doing so makes everything worthwhile.

Tanglin

If you prefer to escape from the hustle and bustle of city life, Tanglin Road’s the area for you. Being an older and more established area, the properties in the area range from spacious houses with huge garden fronts to low rise condominiums. While bringing nature closer to you, the area also provides convenient access to the central areas of Singapore, such as Orchard Road. Additionally, Dempsey Hill, a stone’s throw away from Tanglin Road, houses art galleries, restaurants and cafes for you to unwind and relax.

Holland Village

Holland Village’s laid-back bohemian vibe and diverse dining selection makes it a classic favorite amongst expats. Enjoy a variety of delicious local fare in the large hawker centre that is located in the middle of Holland Village or step out and head to the nearby Jalan Merah Sega for more shopping and dining options. The Circle Line that is right at your doorstep takes you to various parts of Singapore in the shortest time possible.

Bukit Timah

The benefits of living in this area include being in close proximity to several international schools and social clubs such as the Japanese Association, British Club and the Bukit Timah Saddle Club. You may choose to live in one of the many properties that Sixth Avenue has to offer, from family houses with gardens to luxe condominiums.

Robertson Quay

Robertson Quay is an obvious choice amongst younger expats who seek to enjoy the vibrant nightlife offered by the row of restaurants and bars facing the Singapore River. Robertson Quay houses several ritzy new condominiums that offer splendid views of the River. On the other side of Robertson Quay sits UE Square, which is a huge residential, commercial and retail complex.

Sentosa

Sentosa Island houses some of the most luxurious sea-facing homes in Singapore. Residents also get to enjoy a plethora of recreational activities and attractions or bask in the sun at one of the many beaches without having to leave the island. At the gateway of Sentosa stands Singapore’s largest shopping malls, Vivocity, and it offers a dizzying array of retail and dining options. Therefore, many expats who desire an extravagant and unique way of living have made Sentosa Island their home.

East Coast

East Coast is regardless as the most beautify costal line of Singapore. Traditionally, it’s famous with it’s freehold status, sea view, and also the aplenty of foods and good schools. It’s close to CBD, but lack of transportation options, i.e no MRT. However, with the introduction of new MRT in 2016 – Thomson East Coast Line, which running through East Coast area, it had further enhanced the connectivity of the area, and make it one of the most popular choices since then.

Hope the above give you some ideas where to start looking your property in Singapore! As for all existing new launches property, you can checkout Singapore Existing New Launches. Or if you’re looking for upcoming one, you can checkout Most Complete List of New Launches in Singapore.

Shall you have any doubts, or seeking for 3rd party opinions before commit to a purchase, you can always reach out to us. We’re a team of licensed, professional real estate consultants in Singapore which can provide you more insightful information. We’re well-versed in English, Mandarin, Bahasa, and dialects (Cantonese & Hokkien).

What is the Buying Processe?

By now, you have a general idea of Singapore property market, what you can buy, and where to buy. The next steps is to understand the process before you commit a purchase of property in Singapore.

Step 1: Use the Affordability Calculator

Here, you can use our Singapore Bank Loan Eligibility Calculator to check the maximum property affordability based on the current government regulations and property cooling measures. This will only take around five minutes.

Step 2: Check If You Need to Pay Taxes

Foreigners are required to pay Additional Buyer’s Stamp Duty (ABSD) when buying private property in Singapore. Except for US nationals or nationals and Permanent Residents from Switzerland, Liechtenstein, Norway and Iceland, buying the 1st property in Singapore.

Not forgetting also, you need to pay a Buyer’s Stamp Duty (BSD), Legal fee and Mortgage Duty if taking a bank loan to fund the purchase. All this shall take into consideration to finalise your target purchase price to ensure not overstretch your financing.

Step 3: Go Through The Listings

For resale listings, PropertyGuru is the most popular property portal in Singapore. It provides a comprehensive selection of resale HDB flats, ECs and private condos to suit your budget and desired location.

As for existing new launches property, you can checkout Singapore Existing New Launches. Or if you’re looking for upcoming one, you can checkout Most Complete List of New Launches in Singapore.

As a general guide, you should consider proximity to nearby amenities, MRT stations, parks, economic drivers and ease of commuting to work as part of your selection criteria.

Step 4: Hire an Agent

This is optional. But truly, an agent can help you scout for the best deals, do your financial calculations, settle your paperwork and other nitty-gritty details. They will typically charge an agent fee of 1% for resale property, and the amount of work/ time/ saving from price negotiation you save, is typically much more than this 1% fee.

As for new launches under construction, we are appointed as the direct representative of developers for all the projects available in the market. You can look for us, and what best is that you DO NOT need to pay agent commission. Rest assured, you enjoy the direct price and discount are direct from developers.

Step 5: Apply for a Bank Loan

Foreigners are eligible for a bank loan in Singapore. You can get up to 75% financing on the property’s purchase price for the first property and 55% for the second and subsequent property. Bank loans are subjected to floating rates meaning their interest rate can go higher or lower.

We do have long term partnership with various major banks in Singapore. You could enjoy the best rate through our connection/ referral to them. We do have partner to assist you to setup family offices or getting privileges bank account for HNW customers as well. Don’t hesitate to ask us on this!

Step 6: Make an Offer and Seal the Deal

Now that you have found your dream property in the HDB or private property market, it is time to seal the deal.

If you’re getting a HDB resale flats, I do assume you’re at least a Singapore PR, you should have a good knowledge on this from your agent or research. If you’re DIY, you will need to log into the HDB Resale Portal with your SingPass to complete step by step. As the title goes, I shall put focus more on Foreigner Buying Property in Singapore, which is likely a condominiums in most cases.

For condominiums, there is slight different in term of initial deposit and timeline in between Resale vs New Launches. But they are generally similar:

1. Securing the unit:

To secure an unit, you will need to put down a booking fee (we called it “option fee”), in order to exchange the Option to Purchase (OTP) from seller / developer. The booking fee amount:

For resale, it’s 1% of the purchase price, along with “Offer to Purchase“. Seller will issued “Option to Purchase (OTP)” if accepted your offer. This could takes days to weeks depending on the price negotiation and the Term & Conditions stipulated in the Offer to Purchase.

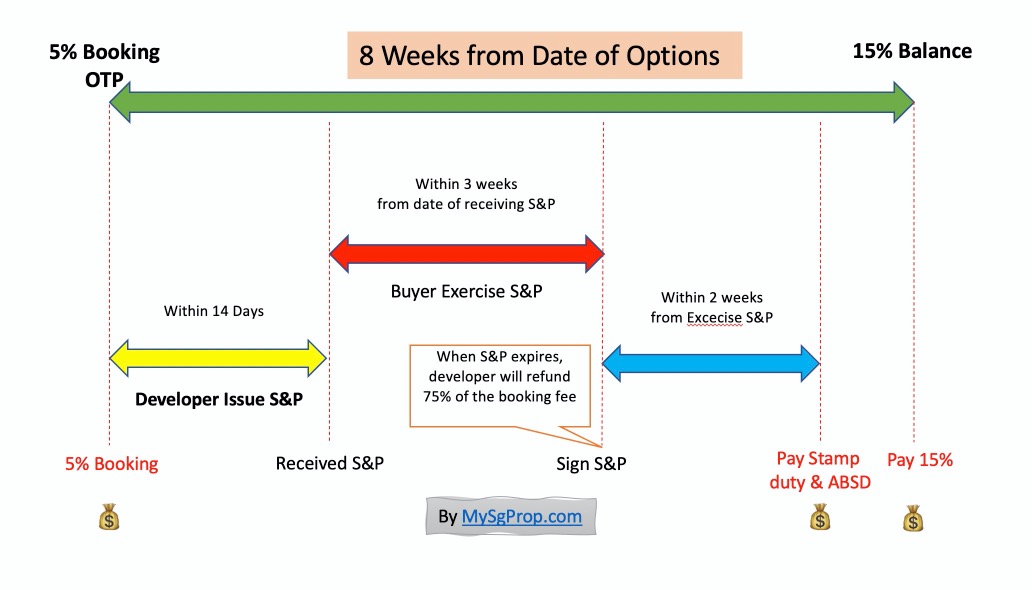

For new launches condominium, it’s 5% of the purchase price. The price is transparent and pretty much fixed without room for negotiate (but no harm to try!). Developer will issued the OTP on the spot in most cases. The OTP is standard document set by government – Controller of Housing (COH).

2. Exercising the OTP:

After you got the OTP, you are given a timeline to exercise it. Once OTP is exercised, you and seller are legally binding, so do think twice before exercising it! Do also try to settled down the bank loan before OTP exercising deadline, so the banker can prepare the mortgage documents in time for you to settle together with OTP. So you don’t need to run multiple times to law firm for signing.

For resale, you will need to exercise it within 2 weeks in law firm, together with the options exercise fee of 4%. If you missed/ change mind not to exercise it, the seller can forfeit your 1% Option Fee.

3. Paying Stamp Duty & ABSD:

After OTP had been exercise, the next bill is Stamp Duty & ABSD:

For both resale & new launches, you will need to pay within 2 weeks from the date you exercise the OTP.

4. Balance Payment:

Now the final bill before getting your keys, the balance payment:

For resale, get ready to get your new homes keys and pay the balanced payment, this happens within 8-12 weeks time after exercising the OTP. Lawyer will invite you once it’s ready. If you’re not taking loan, means you will need to settle the 95% of balanced payment on this day.

For new launches condominiums, on top of your 5% Option Fee, you still have balance of 15% to be paid within 8 weeks from OTP issued date (not exercise date!). If you’re not taking loan, means you will need to pay the bill progressively according to the construction stages as the following:

If you’re investor getting a new launches, you probably only need to worry about the first 60% which doesn’t able to generate any income because it’s still under construction. You will get your key at TOP (Temporary Occupation Permit) stage, which you can rent it out to generate passive income. Singapore rental market is on the raise and always strong demands, most of the case you would still have positive income after deduction of mortgage payment.

For your info, we would typically able to get in tenant within a month time. That’s how strong the rental demands in Singapore.

Summary

Finding and buying a house in Singapore can be complicated — especially for expats, as there are restrictions on the way that foreigners can buy both land and property. However, the mind-boggling amount of information on the internet may be daunting, especially if you’re a foreigner making your first property purchase in the Singapore. When diving into the property market in Singapore, take this guide as your starting point.

Buying a property is always a bit of a leap in financial commitment, and being informed about taxes payable is always vital as it’s part of the cost of property ownership. To avoid falling foul of scams and pitfalls, you’re strongly recommended to go after a local trusted agent’s help and advice for a hassle-free purchasing process. Although there will be a fee to pay for this service, they’ll help you with avoiding costly mistakes, and might be able to negotiate with the seller better than you can alone.

At MySgProp.com, your interests are our number one priority. Let us help you make your purchase decision by getting in touch with us – we are more than happy to be at your service and to provide you with any property information you require to make a better decision as well as any latest property launches.

Shall you have any doubts, or seeking for 3rd party opinions before commit to a purchase, you can always reach out to us. We’re a team of licensed, professional real estate consultants which can provide more insights. We’re well-versed in English, Mandarin, Bahasa, and dialects (Cantonese & Hokkien).

Whatsapp: +65.84188689

Line/ WeChat ID: mysgprop